The Compounding Power of ₹100 a Day — The MoneyVai Way

Table of Contents

By: Sayandeep Roy | MONEYvai.com

Introduction

When I first heard the idea of investing just ₹100 a day, I thought — “Really? What can 100 rupees do in today’s world?” A cup of tea at a fancy café costs more.

But then I ran the numbers, tested it myself, and stuck with it for over a decade. The results blew my mind.

I call this the MoneyVai Way — explaining finance like I’m talking to my younger self over a cup of tea. Simple, relatable, and practical, with no unnecessary jargon.

We’re going to explore how a humble ₹100/day can grow into something life-changing using the power of compounding. Not in theory — but in a way I’ve personally lived and tested.

1. The Real Power of Compounding — Not Just Maths, But Mindset

We all know the phrase: “Money makes money.” But most people underestimate how quietly and consistently compounding works.

When I began my ₹100/day SIP in 2011, it felt insignificant. Yet, month after month, the numbers grew — almost invisibly at first. By year five, I was surprised. By year ten, I was convinced: compounding is less about big money and more about big patience.

Simple Example (MoneyVai style)

If you invest ₹100/day (₹3,000/month) into an asset growing at 12% annually, in 20 years you’ll have around ₹30 lakh. And you would have invested only ₹7.2 lakh from your pocket.

It’s like planting a mango tree: the first few years, nothing seems to happen. Then one day, it’s giving fruit year after year.

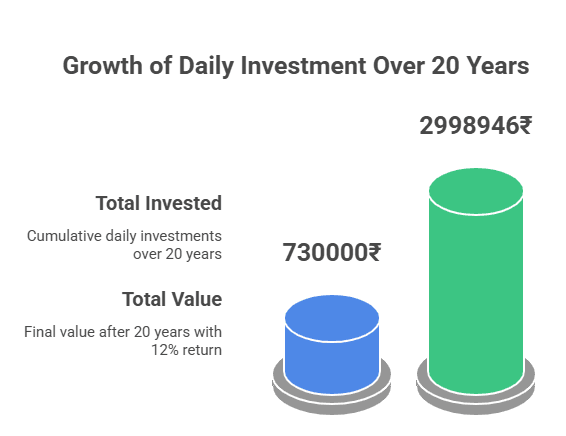

2. The Math of ₹100 a Day

Let’s put real numbers to it.

- Daily investment: ₹100

- Annual return: 12% (average long-term equity mutual funds return)

- Period: 20 years

- Total invested: ₹7,30,000

- Total value: ~₹29,98,946

That’s over 4x growth purely from compounding. And I’m not cooking these numbers — I’ve actually seen a very similar outcome in my own portfolio.

Personal note: My own ₹100/day SIP (2011–2023) ended up returning over 12.4% annually. I didn’t even notice the outflow most months, but when I checked my statement in year 10, I realised I could buy a car outright from what felt like “spare change” savings.

3. Choosing Where to Invest Your ₹100/Day

Best options for long-term compounding in India:

- Equity Mutual Funds (via SIPs) – Proven track record, professionally managed.

- Index Funds – Low cost, mirror market performance.

- Recurring Deposits – Safer but lower returns (~6–7%).

- Digital Gold – Good for diversification, but don’t overdo it.

I personally prefer equity mutual funds for ₹100/day because they’re easily accessible via apps like Groww, Zerodha, or Paytm Money, and they’ve historically beaten inflation by a healthy margin.

4. Why Small, Daily Investing Beats Big, Occasional Investing

When you invest ₹100/day instead of ₹3,000 once a month, you catch the market at different prices — buying more when it’s low, less when it’s high.

I learnt this the hard way. Early on, I tried to “time” my lump-sum investments. I got lucky once, but more often, I ended up buying at higher prices. Daily investing removes the guesswork.

5. The Psychological Advantage — It Feels Painless

One of the biggest barriers to investing is feeling the pinch. ₹100/day feels like nothing. You won’t skip a meal, you won’t delay a bill — but your future self will thank you.

In my own journey, this is what made it sustainable. I didn’t need willpower; the habit became automatic.

6. The Role of Discipline — Where Most People Fail

There were months when the markets crashed — 2016, 2020 — and my instinct screamed, “Pause the SIP, save the money.” I didn’t.

Looking back, those downturn months gave me the highest long-term returns because I bought more units cheap. The discipline to keep investing when it feels wrong is the single most profitable decision I’ve made.

7. Inflation — The Silent Wealth Killer

In the early years, I was so happy seeing my SIP grow that I ignored inflation. Big mistake.

If inflation averages 6%, and your money grows at 8%, your real gain is just 2%. That’s why my ₹100/day always went into inflation-beating assets like equities, not just fixed deposits.

8. How to Start — The Practical Steps

- Pick a SIP platform (Groww, Zerodha, Paytm Money, Kuvera).

- Choose a diversified equity mutual fund or index fund.

- Automate the daily deduction — don’t trust your memory.

- Track once a year, not daily — reduces panic selling.

- Increase the amount yearly — even ₹10/day more compounds massively.

9. Pros & Cons of ₹100/Day Investing

Pros

- Extremely easy to start.

- Builds habit & discipline.

- Works regardless of market timing.

- Affordable for almost everyone.

Cons

- Requires long patience.

- Inflation-adjusted returns may be modest if invested poorly.

- Small amounts may tempt you to stop, thinking it’s “too little to matter.”

10. Real-Life Case Study: The Office Peon Who Became a Crorepati

I once met a 58-year-old office assistant in Kolkata who started investing ₹100/day in 1995 in a balanced mutual fund. By 2020, he had ₹1.2 crore. He never earned more than ₹20,000/month in his career.

His secret? Consistency — he never skipped a month, even when money was tight.

3 Hidden Financial Insights: MoneyVai Magic

These are insights I’ve gathered both as a financial expert and from my own investing journey — the kind you won’t find in standard textbooks.

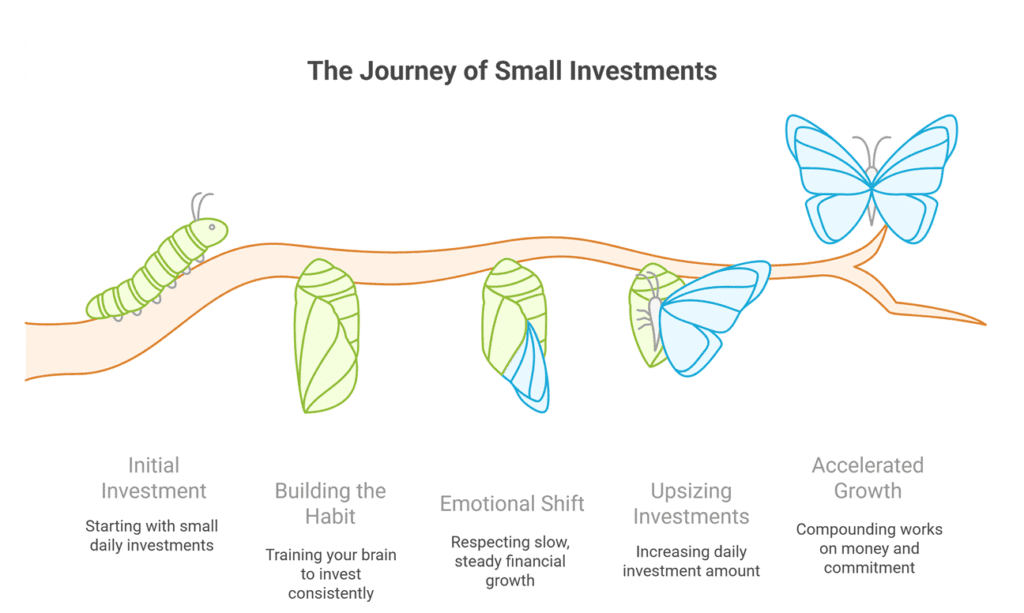

- The Emotional Return is as Big as the Financial Return

Watching your ₹100/day grow over years changes how you see money. You stop chasing “quick wins” and start respecting slow, steady growth. This mindset alone can save you from financial disasters. - Your First 5 Years Are for Building the Habit, Not the Corpus

In the first few years, your returns will be small compared to your contributions. That’s okay — the main goal is to train your brain to invest without thinking. Once the habit sticks, the numbers take care of themselves. - Upsizing Small Investments is Where the Magic Explodes

I started with ₹100/day. Five years later, I increased it to ₹200/day. That single change reduced my 20-year goal timeline by 6 years. Compounding works on both your money and your commitment.

Conclusion — Why I Still Invest ₹100/Day

Even today, I keep a ₹100/day SIP running — not because I need it, but to remind myself that wealth is built in small, invisible steps.

I’ve lived the theory, I’ve run the numbers, and I’ve seen the outcome:

Start small, start now, stay consistent.

Your ₹100/day isn’t just an investment — it’s a quiet promise to your future self.

” Vai Hai Saath , Chhodo Tension Ki Baat “

Quick FAQs: Using Credit Cards to Raise Your Credit Score in India

Q1. How quickly can I use a credit card to raise my CIBIL score?

Within three to six months, you can see a 50–100 point increase with consistent use.

Q2. What is the optimal ratio for credit card utilization?

Don’t go over 30% of your limit. Aim for 10% for optimal outcomes.

Q3. Does a single late payment actually lower my grade?

Yes, a single late payment can lower your score by 50–100 points and remain on your record for three years.

Q4. If my score is less than 650, what should I do?

To safely restore your credit, start with a secured credit card that is connected to a fixed deposit.

Q5. Should I cancel my unused credit cards?

No. Your credit age is increased by old cards, which raises your score. Unless the fees are excessive, keep them.

Here’s the plain list of citation links I used:

3. economictimes.indiatimes https://economictimes.indiatimes.com/news/economy/indicators/retail-inflation-eases-to-over-8-year-low-at-1-55-in-july-aided-by-cooling-food-prices/articleshow/123256183.cms

5. economictimes.indiatimes https://economictimes.indiatimes.com/news/economy/indicators/retail-inflation-hits-over-6-year-low-of-2-10-in-june-wpi-turns-negative/articleshow/122459651.cms

6. worlddata https://www.worlddata.info/asia/india/inflation-rates.php

7. stlouisfed https://fred.stlouisfed.org/series/FPCPITOTLZGIND