Gold as an Investment: Physical vs Digital — The MoneyVai Way

SAYANDEEP ROY | MoneyVai.com

Table of Contents

Introduction

Our Inborn Preoccupation with Gold

If you’re Indian, you were born knowing about gold; you didn’t “learn” it.

Our weddings, our lullabies (“sona beta”), our kitchen cabinets (the ones with the old biscuit tin concealing a chain or two), and even our politics all contain gold (“Gold smuggling racket busted!”).

When I was seven years old, I asked my grandmother why she never wore those bulky bangles and instead kept them locked away. She gave me a look as if I had just inquired as to why the sun rises in the east.

“Beta, this isn’t jewelry; it’s izzat, insurance, and inheritance all combined.”

As I write this, 24K physical gold price is hovering around ₹1 crore per kilogram in India.. Thus, congratulations! If you have a few hundred grams in your locker, you are holding a tiny apartment in South Mumbai. less the upkeep fees and nosy neighbors.

However, the “gold” game has evolved over the past ten years. Through apps, exchange-traded funds (ETFs), or the beloved Sovereign Gold Bonds (SGBs), you can now “own” gold without ever having to touch it. Thus, the query that most irritates my readers is:

“Vai, digital gold isn’t as good as physical gold?”

Let’s resolve this once and for all using data, anecdotes, and some actual MoneyVai hacks.

The Story of Two Friends — Ramesh & Suresh

Allow me to introduce you to two brothers from Cooch Behar: Suresh, the tech-savvy millennial, and Ramesh, the traditional type.

In the year 2015:

At about ₹27,000 per 10g, Ramesh purchased 500 grams of 24K physical gold. ₹13,50,000 was spent in total. He paid ₹2,000 in fees annually and kept it in his bank locker.

For ₹13,50,000, Suresh purchased the same quantity of Sovereign Gold Bonds (₹27,000 per 10g) with no locker fees and 2.5% yearly interest.

By 2025:

The price of 10g of gold is about ₹1,00,000.

They both have gold worth ₹50,000,000.

However, over the years, Suresh has earned ₹3,37,500 in interest. Ramesh? Only security concerns, locker fees, and one brief panic when he believed the bank had moved his locker “to a new section” (which it hadn’t).

A lesson? Almost as important as the asset itself is the form you select.

Physical Gold — The Tangible Treasure

Forms include bars, coins, and jewelry.

I’m a sucker for real gold; in 2011, I bought a tiny 5-gram coin (then worth ₹1,350/gram) as my first real gold purchase. I stored it in a small red velvet box and occasionally removed it to “check purity” (that is, to admire it).

Why People Continue to Adore It

At your cousin’s wedding, you can wear it, see it, and touch it to receive at least four compliments.

It remains the most reliable savings option in rural India.

It cannot disappear due to a “internet outage.”

However, the catch is that charges are being made: 8–20% for jewelry. This is never resold.

GST: 3% up front.

Storage: home security measures or locker fees.

High liquidity, but in an emergency, you might not receive the market price.

For instance, spend ₹1,00,000 on a gold chain. GST total = ₹3,300, making charges = ₹10,000.

You might only receive ₹87,000 to ₹90,000 if you try to sell right away.

Digital Gold — The Click-and-Own Revolution

Digital gold is where you buy gold online in fractions (even 0.1g), stored in a vault by the provider.

Benefits:

- Buy/sell 24×7.

- No storage hassle.

- Start with ₹1.

Downsides:

- Not regulated by SEBI/RBI (yet).

- Storage duration limits (usually 5 years, after which you take delivery or sell).

- Platform trust risk.

Personal hack: If you’re saving for jewellery within 1–3 years, digital gold is an easy way to accumulate grams without worrying about price volatility month to month.

Sovereign Gold Bonds (SGBs) — My Personal Favourite

Issued by RBI, these are gold-backed government securities.

Why I love them:

- Price linked to gold value.

- 2.5% annual interest on invested amount (paid semi-annually).

- No capital gains tax if held till maturity (8 years).

- Tradable after 5 years on exchanges.

Example: Invest ₹5 lakh in SGB. Over 8 years:

- You get ₹10,000/year as interest (total ₹80,000).

- Price appreciation similar to physical gold.

- Zero locker charges.

Gold ETFs — For Stock Market Players

ETFs let you own gold units (1 unit = 1 gram) via demat.

Pros:

- SEBI regulated.

- No making charges or storage issues.

- Easy liquidity through exchange.

Cons:

- Expense ratio (0.5–1% annually).

- Brokerage costs on buying/selling.

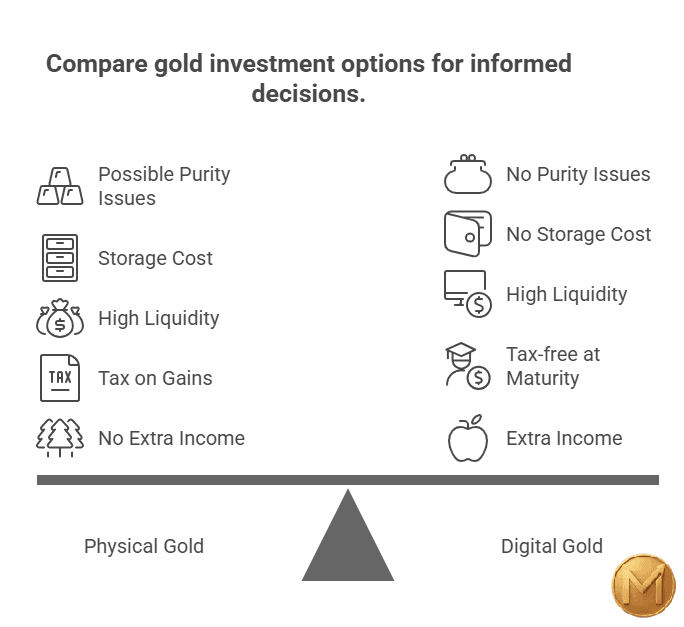

Practical Cost Breakdown

| Feature | Physical Gold | Digital Gold | Gold ETF | SGB |

| Purity Issues | Possible | No | No | No |

| Storage Cost | ₹2k/year | Nil | Nil | Nil |

| Liquidity | High | High | High | Medium |

| Tax on Gains | 20% LTCG after 3 years (with indexation) | Same | Same | Tax-free at maturity |

| Extra Income | None | None | None | 2.5% annually |

Real-Life Money Lessons

- The 2013 Coin Lesson: My friend Ravi bought 100g of coins at ₹2,700/g. He sold in 2014 when it dropped to ₹2,500/g, thinking it was a bad investment. Today it’s ~₹6,500/g. Lesson? Gold is a long-term game.

- COVID Trader Tale: One trader I know dumped stocks in March 2020 and shifted entirely into gold ETFs. By August, his gold portfolio was up 28% while stocks were still recovering.

- Demonetization 2016: Overnight, jewellers saw huge queues as people converted cash to gold — proving gold’s emergency liquidity.

How I Personally Allocate

I don’t believe in keeping all gold in one form. My personal thumb rule:

- 40% in SGBs (long-term growth + interest + tax benefits).

- 30% in ETFs (for easy liquidity).

- 20% in physical coins (emergency + emotional).

- 10% in digital gold (short-term goals).

Pros & Cons ( In Details)

Physical Gold

Pros:

- Tangible asset you can hold.

- No tech dependency.

- High social & emotional value.

Cons:

- Making charges, GST.

- Storage & security costs.

- Price undercut when selling to jewellers.

Digital Gold (ETFs/SGBs)

Pros:

- No storage hassle.

- Purity guaranteed.

- Easy to buy/sell online.

- In SGBs, 2.5% interest + tax-free maturity.

Cons:

- No physical access unless you redeem.

- Lock-in for SGBs.

- ETF brokerage costs.

Pros & Cons at a Glance

| Aspect | Physical Gold | Digital Gold | SGB | Gold ETF |

| Liquidity | Medium | High | Medium | High |

| Storage | Physical risk | Vaulted | No risk | No risk |

| Extra Returns | None | None | 2.5% p.a. | None |

| Tax | LTCG after 3 yrs (20% w/indexation) | Same as physical | No CGT after 8 yrs | Same as physical |

| Emotional Value | High | Low | Low | Low |

| Regulation | Hallmark standards | No central regulation | RBI | SEBI |

Call to Action : Step by Step – How to Start Investing in Gold (Physical vs Digital)

Step 1 – Define Your Goal

Ask yourself this brutally simple question:

• Do you want gold for long-term wealth protection, regular small investments, or for sentimental reasons?

• Do you need instant liquidity, tax benefits, or pure physical control?

Write down your primary goal before taking a single step.

Step 2 – Pick the Right Gold Type

Based on your goal:

• Wealth Protection (8+ Years Hold)? → Sovereign Gold Bonds (SGBs)

• Regular SIPs or Short-Term Trading? → Gold ETFs via your broker app

• Cultural/Legacy Value? → Physical Gold (Coins/Bars)

Avoid mixing them randomly. Strategy beats emotion.

Step 3 – Set Up Your Investment Platform

For Digital Gold (ETFs or SGBs):

• Open a Demat account with a trusted broker – Zerodha, Groww, ICICI Direct, HDFC Securities.

• For SGBs:

– Keep an eye on RBI/Banks announcements (tranches open 2–3 times yearly).

– Subscribe to RBI alerts or check rbi.org.in.

– Apply online or via your bank before the issue closes.

For Physical Gold:

• Buy from MMTC-PAMP or reputed government banks.

• Prefer BIS-certified coins or bars over jewellery if pure investment.

• Avoid flashy jewellery with high making charges.

Step 4 – Plan Your Investment Size

• For SGBs or ETFs:

– Start small – ₹1,000 SIPs are perfect for regular investing.

– For lump-sum SGBs: Decide how much you can lock for 8 years (avoid emergencies).

• For Physical Gold:

– Keep it limited – 5–10% of total gold allocation.

Pro Tip: Never invest emergency funds in gold.

Step 5 – Execute the Purchase

• SGBs: Apply during RBI-issued subscription windows → Fill form online/bank branch → Get allotment → Track holding digitally.

• ETFs: Place buy order on your broker app → No hassles, T+2 settlement.

• Physical Gold: Visit MMTC-PAMP counters or government-authorized banks → Get BIS-certified coins or bars → Store in RBI-approved vaults or trusted lockers.

Avoid buying jewellery purely for investment – the costs kill returns.

Step 6 – Monitor & Maintain

• Digital Gold (ETFs/SGBs):

– Track NAV regularly (daily for ETFs; semi-annually for SGB interest).

– Rebalance your portfolio annually.

– Set SIP automation where possible.

• Physical Gold:

– Ensure safe storage → Use insurance or RBI vaults.

– Periodically review market price vs your cost basis.

MONEYvai Hack: Track government bond auction schedules and market dips to buy smart.

Step 7 – Plan Exit Strategy

• SGBs → Hold till 8 years for tax-free capital gains and interest.

– If needed earlier → Sell on exchange post 5-year lock-in.

• ETFs → Sell anytime with low cost and transparent pricing.

• Physical Gold → Sell via reputable dealers or pawnshops, knowing you’ll face ~3-5% loss.

Write down your exit strategy upfront. Don’t wait for a crisis to panic-sell.

Step 8 – Stay Informed

• Keep an eye on RBI data, SEBI guidelines, and inflation trends.

• Follow reliable platforms (MoneyVai.com, RBI official site, SEBI updates).

• Regularly revisit your allocation – Don’t leave it stagnant for decades.

Smart investing is a habit, not a one-time decision.

Final MoneyVai Thought:

Gold is not speculation. It’s a calculated, low-drama wealth shield.

• SGBs = Best for Core Protection

• ETFs = Best for Liquidity & SIPs

• Physical Gold = Fun heirloom & emergency barter.

Start today with clarity, small steps, and consistent tracking.

Your future self will thank you.

MoneyVai Special Insights

- The “Double Yield” Hack — With SGBs, you earn both capital appreciation and 2.5% interest. At current prices, this interest alone could cover your household’s yearly gas bill — without touching the principal.

- Gold as an “Inverse Panic Index” — In every major crisis since the 1970s, gold prices have spiked. This makes it not just a hedge against inflation, but also against human panic. If you spot fear in markets, gold often quietly fattens your portfolio.

- The Power of Indexation in Tax — Holding gold (physical, ETF, or SGB) over 3 years means you use indexation to reduce taxable gains. In high-inflation years, this can drop your tax outgo by 40–50% — which is like getting a “hidden bonus” from the government.

Conclusion — My Personal Take

Go physical if you want izzat and inheritance stories. Go digital if you want returns and a restful night’s sleep.

My personal portfolio? 80% is in SGBs and ETFs, and 20% is physical (family emotion quota).

Pursuing “multi-bagger” dreams is not the goal of gold. It’s about security, insurance, and the quiet assurance that you’ll never be poor enough to sell your grandmother’s bangles for pennies.

Vai Hai Saath, Chhodo Tension Ki Baat.

Disclaimer

MoneyVai shares knowledge, not instructions. The content on this blog is for learning and awareness only — it is not financial, legal, or investment advice. We create contents for Educational purposes only.Markets move, risks exist, and your money deserves decisions made with care. Always do your own research or consult a licensed advisor before acting.

For more in-depth, well-researched insights, explore MoneyVai Exclusive

FAQs: Gold as an Investment – Physical vs Digital

1. Which is better for a small investor — physical gold or digital gold?

If you’re starting with small amounts (say ₹500–₹5,000), digital gold is like Uber — quick, clean, and zero parking issues. Physical gold is like owning your own car — feels amazing, but comes with storage, safety, and maintenance headaches.

2. Is digital gold safe in India?

Yes, if bought from SEBI-registered platforms or through reputed payment apps partnered with MMTC-PAMP, Augmont, or SafeGold. The gold is stored in insured vaults, not your Google Drive.

3. Can I convert digital gold into physical gold later?

Absolutely! Most platforms let you request delivery of coins or bars (extra charges apply). Think of it as upgrading from a Netflix download to a Blu-ray disc.

4. What’s the minimum investment in physical gold?

You can buy jewellery for as low as 1 gram, but keep in mind making charges can eat up 8–25% of your money.

5. Does physical gold actually give better returns than digital gold?

Returns are identical if purity and price are the same. The difference is in costs—storage, making charges, and liquidity delays make physical gold slightly more expensive in the long run.

6. What are the tax rules for both?

Both are treated as capital assets—held for over 3 years, taxed at 20% with indexation; held for less, taxed at your slab rate. In short: The taxman doesn’t care whether it’s in your locker or on your phone.

7. Which form of gold is more liquid?

Digital gold wins hands down. You can sell it in seconds and get money in your account. Physical gold sale depends on finding a jeweller willing to buy at a fair rate.

8. How do I store physical gold safely?

Bank lockers are safest but cost around ₹1,000–₹5,000 annually. At home, invest in a fireproof safe — unless you enjoy the thrill of wondering if your cupboard is burglar-proof.

9. Can gold prices ever crash badly?

Yes, in short bursts — if global interest rates rise sharply or there’s a sudden dollar rally. But over decades, gold is like your grandma’s love: steady, valuable, and there when you need it.

10. What’s your personal choice — physical or digital gold?

For short-term trading and liquidity, I keep digital gold. For long-term emotional satisfaction (and the occasional flex during weddings), I keep some 24K physical gold bars. A balanced mix works best for me.

Here are the exact webpage addresses (URLs) corresponding to the data sources used:

3. https://www.reuters.com/business/finance/global-markets-view-usa-2025-08-08/

6. https://www.reuters.com/world/china/gold-edges-higher-with-focus-us-inflation-data-2025-08-12/

8. https://www.reuters.com/business/gold-price-stay-above-3000oz-flight-safety-endures-2025-07-28/

11. https://www.mining.com/hsbc-ups-gold-price-outlook-for-2025-and-2026/

13. https://www.reuters.com/business/gold-climbs-record-high-fed-signals-two-rate-cuts-2025-2025-03-20/

16. https://www.reuters.com/world/china/gold-edges-higher-with-focus-us-inflation-data-2025-08-12/

18. https://www.reuters.com/business/gold-price-stay-above-3000oz-flight-safety-endures-2025-07-28/

20. https://www.reuters.com/world/china/gold-extends-rise-fed-rate-cut-hopes-softer-dollar-2025-08-14/