The Smartest Way to Plan Your Money in 2025: MoneyVai’s Guide to Financial Planning

Table of Contents

Introduction

Imagine This: you enter into a mall only to “look around,” and your wallet is suddenly 5,000 rupees lighter, with shopping bags you hadn’t intended for. Sound familiar? Don’t worry, you’re not alone. According to the RBI’s 2025 consumer survey, 7 out of 10 Indians report that impulse purchasing reduces their monthly savings. This is where behavioral finance comes in—the science of why our brain operates like a shopaholic friend, even when our budget says “bhai, bas karo!”

Now here’s where the MoneyVai approach makes life simple. Consider it your street-smart buddy that combines real-world tricks with expert insights to help you recognize money traps before they steal your hard-earned money. It’s not about boring economics lectures; it’s about little, practical nudges that work in everyday life, such as avoiding the “limited time offer” trap or saying no to that fancy cappuccino when an SBI report reminds us that average household debt in 2025 will be at an all-time high.

So, why should you care? Because financial freedom isn’t about being rich tomorrow—it’s about mastering your habits today. Stay with me, dost. The MoneyVai journey is about turning everyday choices into powerful money moves. Ready? Let’s dive.

1. Why Financial Planning Feels Like Dieting (and Why Most Fail)

Bhai, let’s be honest. Financial planning is like dieting. Everyone knows they should save more, spend less, invest smartly. Lekin discipline ka kya? Same like skipping that samosa when you promised salad.

A Quora user once shared: “I planned to save ₹20,000 per month but ended up spending ₹25,000 because friends insisted on Goa trip.” (Sounds familiar, right?).

MoneyVai Says: Discipline isn’t about restriction; it’s about direction. Like you can eat biryani guilt-free if you walked 5 km that day, you can splurge on Goa if your SIPs are auto-deducted.

2. Core Philosophy: MoneyVai’s 3Ds (Discipline, Diversification, Data)

The RBI 2025 report highlights that India’s household savings rate has slipped to 18.5% of GDP from 22% in 2020. Matlab, Indians are saving less but spending more. Time to fix that.

MoneyVai’s 3Ds Framework:

- Discipline – Automatic SIPs, zero excuses.

- Diversification – Don’t put all your eggs in stocks, nor all your rice in biryani.

- Data-Driven – Trust SEBI/RBI numbers, not WhatsApp forwards.

3. Step One: Budgeting That Doesn’t Bore You

Traditional budgeting apps feel like school homework. Instead, use the 50-30-20 rule (50% needs, 30% wants, 20% savings).

╰┈➤Reddit r/IndiaFinance user shared: “After shifting to 50-30-20, I managed to pay off my ₹2 lakh credit card debt in 14 months.”

MoneyVai Hack: Rename your budget categories with quirky tags. “Survival Mode” (rent, groceries), “YOLO Fund” (parties, Zomato), and “Future Me” (investments). This psychological trick keeps you consistent.

4. Emergency Fund: Your Real Best Friend

According to SBI Research (2025), 62% of urban Indians don’t have even 3 months of emergency savings. Matlab ek medical bill, aur poora FD khatam.

MoneyVai Says: Emergency fund = relationship insurance. Keep 6 months of expenses in a liquid fund or high-yield savings account. Don’t touch it for iPhones or Goa.

5. Debt Management: Handle It Like Your Ex

Debt is like that toxic ex. Ignore it, and it will stalk you with compound interest.

- RBI 2025 data: India’s household debt-to-GDP has touched 37%. Credit cards are leading the surge.

- LinkedIn post by a CA: “Pay smallest debt first (snowball method). Builds momentum. Clients report better psychological satisfaction.”

MoneyVai Hack: Use “debt stacking” — pay high-interest loans (credit cards ~36% p.a.) first, then move to education/personal loans.

6. Investments: From FD to AI Stocks

6.1 Fixed Deposits – Safe but Meh

- SBI FD rate (Aug 2025): 6.8% p.a. average.

- Inflation (CPI, July 2025): 5.3%.

Net gain? Barely 1.5%. Safe but not wealth-creating.

6.2 Mutual Funds – The Middle Path

- SEBI data 2025: SIP inflows hit record ₹22,500 crore in July 2025.

- Average 10-year equity MF return: 12–15% p.a.

6.3 Stocks – High Risk, High Drama

Redditor r/IndianStockMarket: “I made 40% on IRCTC but lost 60% on Paytm. Net negative.”

MoneyVai Says: Treat stocks like Tinder dates. Exciting, but don’t marry all of them. Keep 60% core in index funds, 20% in large-caps, 20% for experiments.

6.4 Gold – The Emotional Asset

- RBI 2025 data: Gold demand up 7% YoY as Indians hedge inflation.

- But price is volatile (₹10,000 per gm in Aug 2025).

6.5 New-age Assets – Crypto & AI Startups

- LinkedIn poll 2025: 43% professionals now allocate 5–7% to crypto/stablecoins.

- RBI warns: “Crypto not legal tender, invest cautiously.”

Table 1: Comparing Investment Options (2025)

| Asset Class | Avg Return (p.a.) | Risk Level | Liquidity | Inflation Beating? |

|---|---|---|---|---|

| FD (SBI) | 6.8% | Low | High | Barely |

| Mutual Funds | 12–15% | Medium | Medium | Yes |

| Stocks | 10–25% | High | High | Yes |

| Gold | 7–9% | Medium | Medium | Sometimes |

| Crypto | 20–200% (volatile) | Very High | High | But risky |

7. Insurance: The Boring Hero

According to IRDAI 2025, 70% of Indians are underinsured. Matlab ek accident, aur poora family ka paisa down.

- Term insurance = cheapest life cover.

- Health insurance = must, even if employer provides.

Quora user wrote: “I skipped health insurance at 25, paid ₹4.5 lakh for dengue treatment at 29. Regret forever.”

MoneyVai Hack: Buy health cover early. Premiums at 25 are half of what they’ll be at 35.

8. Tax Planning: Stop Donating Extra to Govt.

- New tax regime (2025): Standard deduction raised to ₹75,000.

- Max limit for 80C remains ₹1.5 lakh.

- 80D (Health Insurance): ₹50,000 for parents, ₹25,000 for self.

MoneyVai Says: Plan taxes in April, not March. Else, you’ll end up buying useless ULIPs just to save tax.

9. Case Studies (Real Stories from Quora, Reddit, LinkedIn)

9.1 Quora – Debt Trap Escape

Ravi shared: “I was earning ₹50k/month, paying ₹15k EMI, yet had 3 credit cards maxed. Started snowball method, cut Zomato orders, cleared debt in 18 months.”

9.2 Reddit – First-time Investor

One user shared: “Started SIP ₹5k in 2020, today portfolio is ₹5.2 lakh (CAGR ~16%). Didn’t need market timing, just patience.”

9.3 LinkedIn – Career & Finance Link

A finance professional posted: “Investing in skill upgradation gave me 40% salary hike, which grew my SIP capacity by 2x. Best ROI ever.”

MoneyVai Says: Sometimes your best investment is you.

10. Retirement Planning: Why 60 Isn’t Retirement Age Anymore

- PFRDA 2025: Average NPS equity plan CAGR = 10.5%.

- Life expectancy in India: 71.5 years (WHO 2025).

If you retire at 60, you still need 20+ years of income.

Table 2: SIP Requirement for ₹5 Cr Corpus by 60

| Age to Start | Monthly SIP (12% return) | Corpus at 60 |

|---|---|---|

| 25 | ₹10,000 | ₹5.1 Cr |

| 30 | ₹17,000 | ₹5.0 Cr |

| 35 | ₹28,500 | ₹5.0 Cr |

MoneyVai Hack: Start early. Time is the real compounding machine.

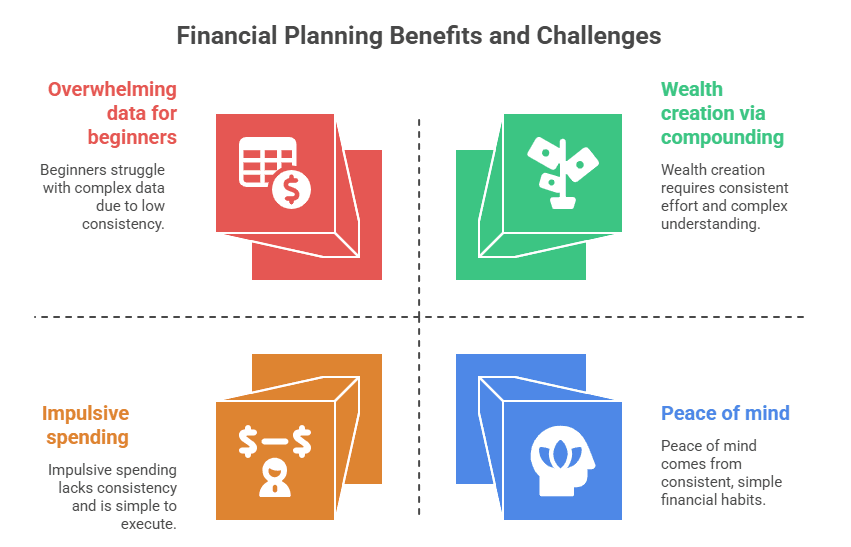

11. Pros & Cons of Financial Planning

Pros

- Peace of mind (you know where money is going).

- Wealth creation via compounding.

- Protection against emergencies.

Cons

- Needs consistency (boring for impulsive spenders).

- Too much data may overwhelm beginners.

- Requires saying “no” to short-term temptations.

12. What Most People Miss (Blind Spots)

- Inflation eating into FD returns.

- Ignoring retirement till late 30s.

- Over-insuring with useless policies.

- Treating crypto like lottery, not asset class.

13. 3 MoneyVai Insights & Myth-Busters

Most people think financial planning is just “save more, spend less.” But dost, real experts—like those IIM grads who breathe balance sheets—see hidden patterns. Let me decode 3 of those ultra-intellectual insights in full MoneyVai vibe, without the jargon.

1. Time Arbitrage is Wealth Creation

Smart investors don’t just buy good assets; they buy time. Imagine two friends start SIPs—one at 22, another at 32. The first friend may invest less overall but still end up wealthier, because compounding loves early birds. In simple words: Paise se zyada, waqt invest karo.

2. Optionality is the Real Asset

Experts don’t cling to one path; they keep doors open. Think of a cricket match—Virat Kohli doesn’t play only cover drives; he waits, adapts, and then strikes. In money, keeping cash ready or diversifying in assets is like holding “options” for uncertain futures. Flexibility = hidden power.

3. Second-Order Thinking in Spending

Normal people ask: “Can I afford this iPhone?” Experts ask: “What’s the opportunity cost of this iPhone over 5 years?” That’s why they build assets while others collect gadgets. MoneyVai Says: Next time you swipe your card, think 5 steps ahead.

╰┈➤Tough to crack, easy to apply. That’s the MoneyVai difference.

Myth vs Reality: The Hidden Truths of Smart Money Moves

- Myth 1: “Debt is always bad.”

Reality: Debt can be your best friend if used smartly. Example: A friend of mine took a home loan at 7.25% (RBI data, 2025) while his investments in equity mutual funds grew at 12%. Net-net, he built wealth while living in his own house. - Myth 2: “Emergency funds are a waste—money just sits idle.”

Reality: Ask anyone who faced a sudden job loss during COVID or a medical emergency. That “idle” cash is what kept them afloat without selling stocks at a loss. It’s not wasted; it’s insurance in disguise. - Myth 3: “Gold is only for weddings.”

Reality: RBI reports show Indians now hold over 27,000 tonnes of gold (2025), making it a silent powerhouse. Digital gold or ETFs can hedge your portfolio just like pros do—without storing lockers full of jewellery.

╰┈➤ MoneyVai Says: “Boring truths beat flashy myths—always.”

14. Call to Action: The “Bhai, Ab Kya Karun?” Section

Friend, ab choice tumhara hai. You can either keep letting EMI, FOMO, and WhatsApp stock tips rule your financial life, or take the MoneyVai route — practical, witty, disciplined, data-backed.

- Start tracking one expense today.

- Open a SIP of at least ₹1,000/month, even if you think it’s chillar.

- Talk to family about insurance and wills (yes, awkward but necessary).

- Build a mini side hustle; let it fund your investments.

MoneyVai Says: Start small, stay consistent. Even Ambani didn’t become Ambani in one month.

Start with one hack today — maybe auto-SIP, maybe debt snowball. Future you will high-five you.

15.Conclusion

At the end of the day, financial planning isn’t about chasing quick tips or memorizing complex formulas—it’s about clarity, discipline, and a little bit of courage. The MoneyVai approach reminds us that even the toughest financial concepts can be broken down into simple, everyday actions. Whether it’s resisting a spending trap, building that boring-but-powerful emergency fund, or thinking like the top 1% without drowning in jargon—you have the power to make money your partner, not your stressor.

Remember, money doesn’t need to be complicated; it needs to be consistent. Aaj ek chhota step, kal ek bada result. When you approach money with curiosity instead of fear, opportunities begin to open up.

So, keep it simple, keep it smart, and keep it MoneyVai.

Vai Hai Saath , Chhodo Tension ki Baat

For more in-depth, well-researched insights, explore MoneyVai Exclusive

FAQs

What’s the first step in financial planning for beginners in India (2025)?

Start with budgeting and expense tracking. Use RBI-backed UPI apps or SBI YONO for free tools to track spends.

How much should I invest from my monthly salary?

A good thumb rule is the 50-30-20 principle (50% needs, 30% wants, 20% savings/investments). Adjust based on your lifestyle.

Is SIP still the safest way to start investing in 2025?

Yes, SEBI-regulated SIPs in mutual funds remain beginner-friendly, especially with auto-debit features reducing human error.

How do I avoid behavioral money traps like impulse spending?

Use the 24-hour pause rule: delay non-essential purchases for 24 hours. 8/10 times, you’ll skip the spend.

What’s one MoneyVai Hack for smart financial planning in 2025?

Automate everything – SIPs, RD/FD, insurance premiums. Automation beats motivation every single time.

CITATION

Reddit

https://www.reddit.com/r/personalfinanceindia/comments/1f70sgg/the_503020_rule_a_simple_guide_to_budgeting_your/

https://www.reddit.com/r/personalfinanceindia/comments/1h030lx/how_to_budget/

https://www.reddit.com/r/personalfinanceindia/comments/1iwqd4y/how_to_budget_money_as_a_21_year_old/

https://www.reddit.com/r/personalfinanceindia/comments/1imvv8j/how_to_save_money/

https://www.reddit.com/r/personalfinanceindia/comments/189nqfp/im_29_and_currently_in_a_debt_of_10_lakhs/

https://www.reddit.com/r/personalfinanceindia/comments/1gfycqg/my_current_situation_is_overwhelming/

https://www.reddit.com/r/personalfinanceindia/comments/174qknw/how_do_i_pay_off_my_loans_and_clear_all_the_debt/

https://www.reddit.com/r/personalfinanceindia/comments/1j8wvnm/seeking_advice_how_to_avoid_debt_and_build_a/

LinkedIn Case Study Links (via news articles referencing them)

- economictimes.indiatimes.com/magazines/panache/10-times-salary-increase-in-5-years-ankur-warikoo-shares-roadmap-and-the-career-bet-that-worked-for-him/articleshow/122024811.cms

- timesofindia.indiatimes.com/etimes/trending/rs-70-lakh-salary-and-still-struggling-viral-linkedin-post-tells-about-the-new-middle-class-trap-in-india/articleshow/122004362.cms

GOVT

MoSPI – Ministry of Statistics & Programme Implementation

https://mospi.gov.in/sites/default/files/press_release/NAD_PR_30may2025.pdf

https://mospi.gov.in/financial-assets-and-liabilities-household-sector-current-prices-₹-crore-2011-12-2023-24-base-year

SEBI – Securities and Exchange Board of India

https://www.sebi.gov.in/reports-and-statistics/research/sep-2024/study-analysis-of-profits-and-losses-in-the-equity-derivatives-segment-fy22-fy24-_86905.html

Ministry of Finance (Economic Survey / Budget)

https://www.indiabudget.gov.in/economicsurvey/

https://www.indiabudget.gov.in/doc/budget_at_glance/bag1.pdf

PFRDA – Pension Fund Regulatory and Development Authority

https://www.pfrda.org.in/documents/33652/203559/Handbook%2BMerged%2B31.05.2025.pdf

https://www.pfrda.org.in/documents/33652/145901/PFRDA%2BPension%2BBulletin%2BJune%2B2025.pdf

RBI – Reserve Bank of India

https://rbi.org.in/commonman/english/scripts/PressReleases.aspx?Id=3179