Should You Invest in Stocks or Start a Small Business? Know the Risks First

- INTRODUCTION

- 1. The Big Dilemma: Risk vs Reward

- 2. The Data-Backed Reality of Risks

- 3. Story Time: A Friend’s Dilemma

- 4. Case Studies from Real People

- 5. MoneyVai Hacks for Risk Balancing

- 6. Pros & Cons Breakdown

- 7. Comparison Tables

- 8. My Own Take (Personal Story)

- 9. What Smart People Do (Blended Model)

- 10. Official & Entrepreneurial Takes on Investment Risk

- 11. MoneyVai Special Insights & Myth-Busters

- 12. Call to Action : Step by Step – Stock Market vs Small Business

- 13. Conclusion

- Disclaimer :

INTRODUCTION

Imagine this: The IPL final is here.

In the last over, Virat Kohli is trying to get 20 runs.

Some fans are biting their nails (those who take risks), while others have already turned off the TV (those who shun risks).

We all have to choose between khelna and safe rehna when it comes to money and life.

Every aspiring Indian faces the same problem:

“Should I start my own business or invest in stocks?”

This is the truth:

SEBI’s 2025 data shows that more than 82% of retail investors lose money because they don’t stick to their plans.

According to RBI data, 90% of small businesses have trouble with cash flow in their first five years.

Both of them are at risk, boss!

But the wise question isn’t “which is safer?” — it’s “which risk is right for you?”

That’s where the MoneyVai approach comes in:

No jargon, no boring theories.

Just easy, useful hacks explained like gupshup, with expert advice to back them up.

This blog will not only dispel myths, but it will also provide you clear, actionable strategies to take charge of your money.

Unlike random WhatsApp forwards, this guide is powered by official and trusted sources. This is the backbone of MoneyVai : T R U S T

1. The Big Dilemma: Risk vs Reward

Ask any ambitious Indian, “Stock Market ya Apna Business?” and you’ll get heated discussions. Both look glamorous from the outside: stocks promise money while you sleep, while business screams boss life. But let’s cut the filmy drama and talk real numbers.

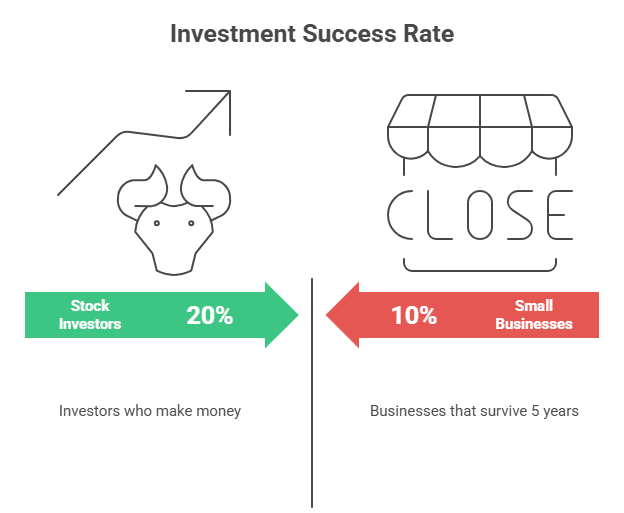

In India, more than 90% of small enterprises fail after five years because they didn’t plan well, didn’t have enough money, or just had bad luck. On the other hand, more than 80% of retail investors in stocks lose money because they follow the crowd, are afraid of missing out, and don’t do any research. Do you see the pattern? It’s not “which option” you take that puts you at risk; it’s how ready you are.

So, instead of asking “Which is riskier?”, flip the question: “Am I ready to handle volatility (in stocks) or uncertainty (in business)?” Because risk isn’t a monster outside, it’s often inside your mindset and your money habits.

2. The Data-Backed Reality of Risks

2.1 Small Business Survival Rates in India (2025 Updates)

According to the Ministry of MSME, Government of India (2025 report):

- Around 30% of new small businesses shut down within the first 2 years.

- By the 5th year, nearly 50% struggle to survive.

- By the 10th year, only about 20–25% remain operational.

Why? Because of:

- Poor cash flow management.

- High competition.

- Lack of proper digital adoption.

- Rising compliance and taxation challenges.

Basically, running a business is like riding a Royal Enfield in heavy Kolkata traffic. Thrilling, but ek galti… aur game over.

2.2 Stock Market Risks in 2025

Now, let’s peek into SEBI + RBI data (2025):

- Nifty 50 delivered 13.8% CAGR over last 10 years (2014–2024).

- Retail participation has jumped massively: 12 crore demat accounts in 2025 (NSDL + CDSL combined).

- Systematic Investment Plans (SIPs) in mutual funds hit ₹22,000 crore per month inflow (Jan 2025, AMFI data).

But…

- Short-term volatility is brutal. For example, in 2020, Nifty crashed 40% in two months. In 2022, global inflation triggered a 10% correction.

- 99% of intraday traders lose money over time (SEBI study, 2023).

Market risk feels less “end of the world” because you can diversify. But if you put all money into one stock, toh Tata-bye-bye ho sakta hai.

3. Story Time: A Friend’s Dilemma

One of my close friends, Abhishek, had ₹10 lakh savings in 2019. He had two choices:

- Option A: Start a small café near his college campus.

- Option B: Put the money into stock market mutual funds.

Abhishek chose the café. Within 18 months, COVID hit. Lockdowns shut him down. He lost almost everything.

Meanwhile, another friend, Sagar , who invested ₹10 lakh in a simple Nifty Index fund in 2019, has ₹21 lakh today (2025).

Lesson? Sometimes risk isn’t in the opportunity—it’s in the timing and external shocks.

MoneyVai Says: “Business gives you control, but not certainty. Market gives you uncertainty, but not responsibility.”

4. Case Studies from Real People

4.1 Reddit: The Control vs Skill Debate

On r/business, one user bluntly wrote:“Any fool can make a return on a stock exchange tracker fund… investing in your own business—but if you don’t know what you’re doing, you stand a very good chance of losing everything.”Kya baat hai! This is the heart of the debate. The stock market rewards patience, while business rewards skill (and punishes the lack of it). Another Redditor summarized it perfectly:“High risk, high return. Index funds are safer. It depends on your skills and goals.” ( Source : Reddit )

MoneyVai Says: “Stock market needs knowledge of numbers; business needs knowledge of people. Which one do you enjoy more?”

4.2 Reddit: The Real-Life Windfall Choice

On r/FinancialPlanning, someone compared running a photography business vs putting that same money in stocks:“Photography business = lot more time and work, but you can double your money within a year if you’re good. Stock market is 0 work, but it’ll take much longer to double your $1K.”This is such a classic trade-off! Business = sweat equity + higher upside. Stocks = patience + compounding. Both can make you rich, but the timelines and stress levels differ. ( Source : Reddit )

MoneyVai Hack: “If you’re young and hungry, try business for higher growth. If you’re busy and stable, stocks may suit you better.”

4.3 Reddit: Students Starting Small

On r/india, a student shared:“You don’t need initial money—what matters is buyers. I sold chana masala during summer vacation made by my mom.”Pure bootstrap energy! This shows that entrepreneurship doesn’t always need venture capital or fancy plans. Sometimes, it just needs guts and a good product. ( Source : Reddit )

MoneyVai Says: “Zaroorat se zyada paisa mat dhoondo, zaroorat se zyada buyers dhoondo.” (Don’t chase big funding, chase real customers.)

4.4 LinkedIn Insight – Daniel Sweet’s Perspective

On LinkedIn, Daniel Sweet shared how stock market falls affect small business owners. His point was sharp:Market crashes may scare investors, but for entrepreneurs, they can be a blessing in disguise.During downturns, weaker competitors may fold, giving you a chance to grab more market share.BUT (and this is the catch), funding becomes harder, banks tighten credit, and many panic-sell their investments. ( Source : Linkedin )

MoneyVai Hack: “If you run a business, build a survival fund. Don’t let a market crash push you into panic mode—use it to bargain hunt for customers, suppliers, or even competitors.”

5. MoneyVai Hacks for Risk Balancing

- Don’t Bet Everything on One Horse

If you have ₹10 lakh, don’t dump it all in stocks or all in a shop. Split: 60% in equities, 40% in business idea. - Test the Waters Cheaply

Before opening a full café, Abhishek could have started a cloud kitchen with ₹2 lakh. Less rent, less headache. - Emergency Fund First

Whether market or business, always keep 6–12 months expenses in liquid funds or bank FD. - Use Government Schemes

- CGTMSE Scheme (2025): Government gives collateral-free loans up to ₹2 crore to small businesses.

- Startup India Seed Fund Scheme: Provides up to ₹50 lakh support for innovative startups.

MoneyVai Hack: “Apna paisa mat jalao testing mein. Government aur VC ka paisa use karo—risk unka, return tumhara.”

6. Pros & Cons Breakdown

6.1 Stock Market

Pros:

- Liquidity (you can sell anytime).

- Diversification possible.

- Long-term wealth creation proven.

- Lower entry barrier (₹500 SIP se shuru).

Cons:

- Short-term volatility = heart attack moments.

- Requires discipline & patience.

- Overconfidence leads to losses (F&O trap).

6.2 Small Business

Pros:

- Full control & independence.

- Potential for very high returns.

- Builds brand, legacy, and jobs.

- Government schemes available.

Cons:

- High failure rate (50% by 5 years).

- Stress, long hours, family pressure.

- Cash flow & credit crunch risk.

- External shocks (COVID, regulation).

7. Comparison Tables

Table 1: Risk & Return Profile

| Factor | Stock Market (Equities) | Small Business (MSME) |

|---|---|---|

| Average Returns (10 yrs) | 12–14% CAGR (Nifty/Sensex) | Varies (10% loss to 1000% gain) |

| Failure Rate | <10% if diversified | ~50% in 5 years |

| Liquidity | High (T+1 settlement) | Low (hard to exit) |

| Stress Level | Medium | Very High |

| Control | Low | High |

Table 2: Risk Mitigation Options

| Risk Type | In Stock Market | In Small Business |

|---|---|---|

| Market Volatility | Diversification, SIPs | Pivoting, multiple revenue streams |

| Cash Flow | Not applicable | Maintain reserves, credit line |

| Regulatory | SEBI monitored | Compliances, CA guidance |

| Failure Protection | Stop-loss, exit anytime | Insurance, govt schemes |

8. My Own Take (Personal Story)

When I first thought about starting MoneyVai, I stood at a crossroad.

On one side was trading. something I already practice. It’s fast, exciting, and gives direct financial results (sometimes gains, sometimes losses).

On the other side was blogging, starting a finance blog. A slower path, but one where knowledge compounds like SIP.

Right now, MoneyVai is at its early stage. No big income yet. Some people may say, “Blogging se kya hoga? Trading is quicker!” But I believe that, just like SIP grows over time, this blog too can grow into a reliable income stream if I stay consistent.

MoneyVai Says : Every business looks risky at the beginning. The key is passion + patience. Trading gives thrill, blogging gives depth. I’m betting that in the coming years, both together will create balance.

9. What Smart People Do (Blended Model)

Many successful people do this combo:

- Stable Wealth via Markets: SIPs, ETFs, Index Funds.

- Growth Bets via Business: Side hustles, startups.

Example: A Reddit user shared how he invests 50% salary in index funds while running a photography studio on weekends. Even if studio fails, his market investments compound.

10. Official & Entrepreneurial Takes on Investment Risk

For those standing at the crossroads of investment and entrepreneurship, the following insights distinguish fleeting trends from perennial wisdom.

Government Official (SEBI Chairman, July 2025)

“While the stock market offers liquidity and regulated transparency, our data shows most retail traders lose money. Wise diversification and knowledge are essential—risk management is no longer optional, it’s foundational.” : TOI

Central Banker (SBI Managing Director, July 2025)

“Small business is the engine of employment and innovation in India, but sustainability demands robust cash-flow discipline and fraud prevention. Risk in MSMEs is not just financial—it’s existential.” : ET

Successful Businessman (Indian Startup Founder, 2025)

“Taking risks in entrepreneurship is like climbing Everest without a sherpa—preparation and adaptability are everything. The market gives quick results, but building a business tests your every limit.” : Bizplanr

11. MoneyVai Special Insights & Myth-Busters

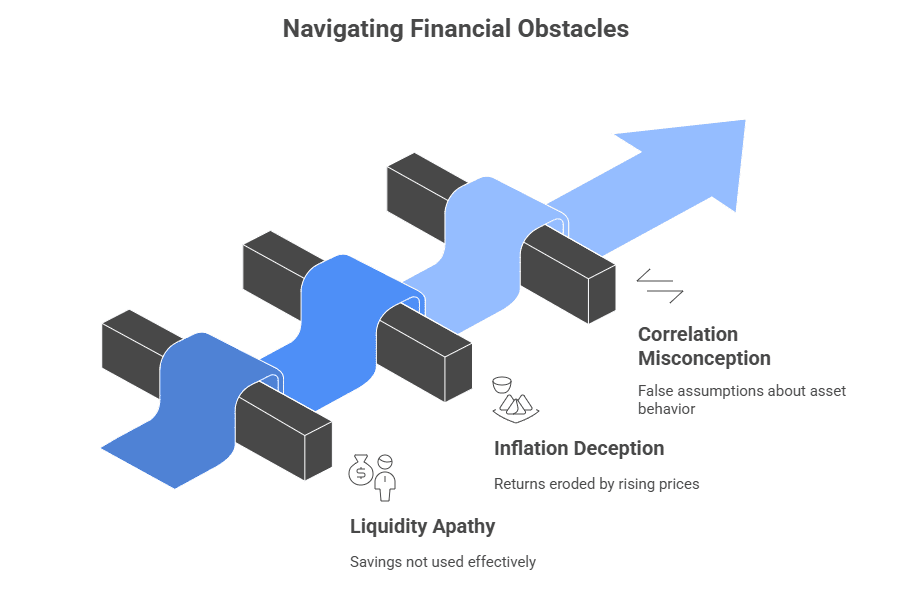

- 1. Liquidity Trap in Daily Life

Sounds like PhD-level jargon, right? But think of it like this: you’ve ₹1 lakh lying in your savings account. You don’t spend it (because you’re “saving”), banks don’t lend aggressively (because demand is weak), and the economy doesn’t grow. It’s like water stuck in a pipe. MoneyVai Says: Your money must keep flowing, FDs, SIPs, or even part-time side hustles—else inflation eats it quietly.

- 2. The “Risk-Free” Myth

Government bonds are tagged “risk-free,” but in real life, inflation risk bites harder. Imagine you lend your friend ₹100 and he returns ₹105 after a year. But in that year, samosa prices doubled. You “earned” ₹5 but lost in reality. MoneyVai Hack: Always compare “returns vs inflation,” not just the nominal number.

- 3. Correlation Illusion

Most people think if the stock market is falling, gold always rises. Truth? Not always. In March 2020 crash, both dipped initially because everyone ran for cash. MoneyVai Says: Never rely on textbook shortcuts, look at real-world data, not WhatsApp gyaan.

11.1 Myth vs Reality

Myth 1: “High salary = financial security.”

Reality: A friend of mine earns ₹2 lakh/month in IT but still scrambles at month-end because EMI + lifestyle > income. A school teacher with ₹40k salary but disciplined SIPs is way wealthier in net worth.

MoneyVai Says: Security comes from planning, not paycheck size.

Myth 2: “Owning a house is always an asset.”

Reality: A cousin bought a flat in 2015 for ₹50 lakh. Today, it’s still ₹55 lakh. But he’s paid ₹25 lakh in EMIs + maintenance. Net gain? Negative.

MoneyVai Hack: Asset is what pays you back (like rental property), not what just eats cash.

Myth 3: “Side hustles are risky distractions.”

Reality: A neighbor started weekend baking on Zomato, earns ₹20k/month extra—this cushions her job insecurity.

MoneyVai Says: Risk isn’t hustling, risk is depending only on one salary.

12. Call to Action : Step by Step – Stock Market vs Small Business

If you’re standing at the crossroads of Stock Market vs Small Business, confused about where to put your hard-earned paisa… stop right there. Let’s break it down, step by step, in the simplest way possible.

This is not rocket science. This is smart financial planning.

Step 1: Assess Your Risk Appetite

Ask yourself honestly:

• Can I handle a 30% portfolio dip without panic-selling?

• Do I want complete control over my income or prefer a passive source of wealth?

If your answer is “I prefer less stress and long-term growth,” start with mutual funds or index funds.

If you’re an action-taker who loves challenges, keep a small side business idea in mind.

MoneyVai Says: “Know thyself first before investing thy money.”

Step 2: Build a Safety Net First

Before making any decision, build your emergency fund.

• Keep at least 6–12 months of personal expenses in a liquid fund or fixed deposit (RBI’s recommendation).

• This protects you from unexpected shocks—whether market crashes or business failures.

MoneyVai Hack: Treat this as “non-investable cash.” Don’t touch it unless there’s an emergency.

Step 3: Start Small, Dream Big

Don’t go all-in.

• If you want to start a small business, begin with a low-investment pilot project.

Example: Before opening a restaurant, try a home-based cloud kitchen or selling snacks via Swiggy/Zomato. Initial cost: ₹1–3 lakh.

• For stock market, start a Systematic Investment Plan (SIP) with as low as ₹500/month in an Nifty index fund.

RBI Data (2025): SIPs grew by 15% compared to last year, showing the power of consistency.

MoneyVai Hack: “Risk ko chhota rakho, dreams ko bada.”

Step 4: Leverage Government Support

Don’t reinvent the wheel. Use available schemes:

• Startup India Seed Fund Scheme → Upto ₹50 lakh seed capital support for innovative business ideas.

• CGTMSE Scheme → Collateral-free MSME loans upto ₹2 crore.

• RBI’s MSME Digital Credit Guidelines help prevent fraud and reduce risk in digital transactions.

MoneyVai Says: “Government ki schemes ko ignore karna paisa jalana hai.”

Step 5: Diversify Smartly

Never put all eggs in one basket.

• Split your capital:

– 60–70% in index funds (like Nifty ETFs or SBI Mutual Funds).

– 30–40% for low-risk side business (home business, freelancing, small service venture).

Example: A friend of mine invests ₹7 lakh in SIPs and runs a ₹3 lakh photography side hustle. Both grow independently.

Step 6: Learn Continuously

Knowledge compounds faster than money.

• For Market → Read SEBI’s investor education resources or books like “The Intelligent Investor” by Benjamin Graham.

• For Business → Learn basic accounting, legal compliance, and customer acquisition strategies.

MoneyVai Hack: Take free financial literacy courses from RBI’s website before starting any investment or business.

Step 7: Revisit Every 6 Months

• Review your portfolio and business performance every 6 months.

• For Stocks → Rebalance according to market trends (e.g., shift from mid-caps to index if volatility rises).

• For Business → Reevaluate customer needs, pivot if necessary (learn from Priya’s pivot to healthy lunch delivery).

MoneyVai Says: “Jab tak feedback loop nahi banta, risk management incomplete hai.”

Step 8: Think Exit Strategy

Plan before you begin.

• Stocks → Always keep liquidity in mind (e.g., invest in large-cap ETFs over penny stocks).

• Business → Have a plan if it doesn’t work. Example: Sell equipment, shift to freelancing, or close without loans.

RBI (2025): 40% of failed MSMEs took over 6 months to liquidate. Don’t be one of them.

Final MoneyVai Tip: Don’t aim for quick riches. Aim for steady growth, balanced risk, and smart decisions.

This way, your financial journey becomes sustainable—not a risky gamble.

13. Conclusion

At the end of the day, doston, the question of “Stock Market vs Small Business. kaunsa zyada risky hai?” isn’t only about figures; it’s also about how you think. Risk isn’t just in the market or in starting a business; it’s also in not having a plan. A trader who buys stocks without doing their homework is as subject to risk as a store owner who begins a business without knowing what customers want.

Managing risk is what finance is all about, not avoiding it. You can always manage it, whether by spreading your investments across several stocks or by making sure your dukaan has a steady stream of cash. Keep in mind that both methods can lead to wealth, but you need to be patient, have a plan, and think a little bit smart.

So instead of asking “which is more risky?” – ask yourself, “Do I have a plan?” With the correct attitude, even risk can turn into an opportunity.

AI’s Take from Mathematical Viewpoint ( Only for Math Fanatics ) – Optional

Hey! Let’s end the argument: which is a higher financial risk, establishing a business or investing in the stock market? We’re using cold, hard math to figure it out. Forget about your gut feelings; we’re talking about Value at Risk (VaR), standard deviation, and likelihood.

The Players:

- Stock Market (S&P 500 Proxy): We’ll assume an expected annual return (E[R_m]) of 10% with volatility (standard deviation, σ_m) of 15%. Returns are roughly normally distributed.

- Small Business: This is trickier. Data shows ~20% fail in Year 1 (a -100% return). For survivors, let’s assume an average return of 15%. This gives us a blended expected return (E[R_sb]) of -4%. For risk, we’ll use a high volatility (σ_sb) of 60%.

Round 1: Probability of a Loss (P(Loss))

We calculate the Z-score, which measures how many standard deviations away from the mean a result is. The formula is:Z = (Target Return - Expected Return) / Volatility

- Stock Market:

Z = (0% - 10%) / 15% = -0.67- Checking a Z-table, this corresponds to a P(Loss) of 25.1%. So, a 1-in-4 chance of a down year.

- Small Business:

Z = (0% - (-4%)) / 60% = 0.067- This Z-score doesn’t even fully capture the risk due to the high failure rate. The sheer volatility suggests a P(Loss) well above 40%.

Winner (for being less risky): The Stock Market.

Round 2: Worst-Case Scenario (5% Value at Risk – VaR)

VaR tells us the maximum loss we can expect in the worst 5% of cases. The Z-score for the 5th percentile is -1.645.VaR = Expected Return + (Z * Volatility)

- Stock Market:

VaR = 10% + (-1.645 * 15%) = -14.7%- In a terrible year, you might lose ~15%.

- Small Business:

VaR = -4% + (-1.645 * 60%) = -102.7%- Yikes. The math says you could realistically lose your entire investment and then some in the worst-case scenario.

Winner (for being less risky): The Stock Market, by a landslide.

The Vibe Check:

The numbers don’t lie. While the stock market has its dips, its risk is quantified and relatively contained. A small business is a high-stakes, binary outcome—often boom or bust. The stock market is a calculated risk; a startup is a passionate gamble.

NOTE : This particular paragraph is AI’s perspective. Consult any financial advisor for better inputs.

Vai Hai Saath , Chhodo Tension ki Baat

Disclaimer :

MoneyVai shares knowledge, not instructions. The content on this blog is for learning and awareness only — it is not financial, legal, or investment advice. We create contents for Educational purposes only.Markets move, risks exist, and your money deserves decisions made with care. Always do your own research or consult a licensed advisor before acting.

MoneyVai empowers readers with reliable, fact-based financial knowledge that’s simple, clear, and never complicated like others. It brings India’s best finance, business, and tech articles—helping you grow wealth, save smartly, and stay ahead with ease.

For more in-depth, well-researched insights, explore MoneyVai Exclusive

FAQs

Is the stock market risk really higher than small business risk in India 2025?

Not necessarily. SEBI’s 2025 volatility index shows average equity market risk is around 18–22%, whereas MSME Ministry data reveals that 40–50% of small businesses shut within 5 years. Stock market risk is market-driven; small business risk is survival-driven.

Which gives better long-term wealth — investing in stocks or running a business?

Running a successful small business can beat the stock market (returns of 20–30% yearly aren’t uncommon), but failure rates are high. The NIFTY 50 delivered ~14% CAGR (2000–2025), making equities safer for the average person.

Can diversification reduce both stock market and business risks?

Yes. In stocks, diversification across sectors reduces volatility. In business, multiple income streams (side hustles, product range, online + offline sales) act as natural diversification. MoneyVai Says: “Jab risk ko todoge, risk tumhe tod nahi payega.”

Why do most people underestimate business risk but overestimate stock risk?

Because stock risks are visible daily on trading apps, while business risks (delayed payments, operational costs, sudden regulation changes) unfold slowly. Psychology makes us fear what we see, not what silently bleeds us.

What role does financial planning play in reducing risk in both cases?

Huge role. In the stock market, SIP (Systematic Investment Plan) and asset allocation keep emotions in check. In business, maintaining 6–12 months of working capital (as advised by RBI 2025 MSME framework) can save you during crises.

CITATION

- SEBI Press Release – 93% Traders Loss in F&O (2022–2024)

- Economic Times – SIP Inflows ₹26,000 Cr+

- PrimeInvestor – Nifty 50 Returns

- AMFI India – Monthly Data

- MSME Ministry – Reports & Publications

- NITI Aayog – Enhancing Competitiveness of MSMEs (2025)

- IBEF – MSME Sector Overview

- Moneycontrol – SEBI F&O Losses Report

- FT – Regulatory Challenges in India