How to Teach Kids About Money Without Boring Them in India (2025 Edition)

Table of Contents

Have you ever observed that your 8-year-old understands all the stats for every IPL player but can’t tell you why saving ₹50 is important?

Honestly, it’s both funny and scary at the same time.

Kids are like little data sponges, but when it comes to money, most of us parents freeze up like Hardik Pandya when he sees a last-ball yorker.

This is where the MoneyVai approach comes in.

It’s simple, smart, and useful, and it has IIM-level insights that even your neighbor who “knows finance” secretly wishes they possessed.

You can educate your kids how to manage money like a small business without tedious lectures, PowerPoints, or terrifying words like “inflation” or “CAGR.”

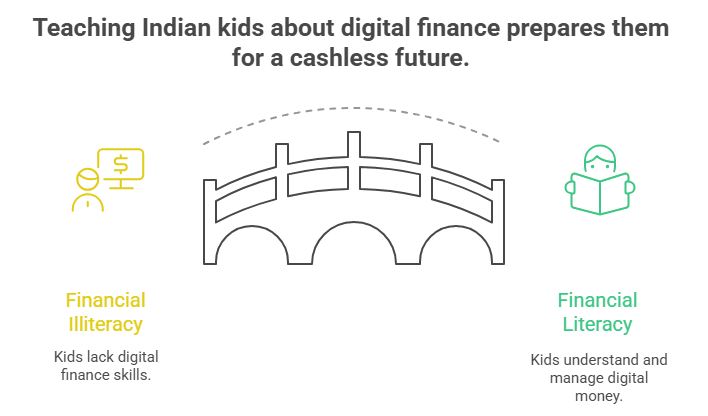

Let’s be honest: in 2025, when RBI reports more than 16 billion UPI transactions every month and SEBI shows a 22% year-over-year surge in household investments, knowing how to handle money isn’t an option — it’s a matter of life and death.

This blog will turn lessons about money into stories, games, and hacks, so your child will have fun learning and gaining skills that will last a lifetime.

Unlike random WhatsApp forward, this guide is powered by official and trusted sources. This is the backbone of MoneyVai : T R U S T .

1. Why Teaching Kids About Money Is No Longer Optional

India is not the same as it was when we were kids in 2025.

We used to worry about the most expensive things, like a ₹5 sweets or cricket cards.

Kids these days? They’re swiping UPI before they learn multiplication tables.

The RBI’s 2025 Digital Transactions Report says that UPI has more than 16 billion transactions in just one month.

What does that mean?

A 10-year-old can even notice their parents using their phones at kirana shops.

Money is no longer an idea; it’s real, rapid, and digital.

And here’s the best part: The 2025 Household Savings Report from SEBI shows that Indian families are putting more money into financial assets like mutual funds and SIPs than gold.

That indicates future generations will require smarter financial habits, not merely the “save in gullak” mantra.

MoneyVai Says: If we don’t teach kids about money now, Google Pay and Instagram ads will do the teaching for us.

2. The Mindset Shift: From “Paise Kharch Mat Karo” to “Paise Samajh Ke Karo”

Our parents’ generation equated “money lessons” with scolding:

- “Switch off the fan, bijli ka bill aayega!”

- “Maine bola tha pocket money ko mat udaana!”

But let’s be honest — did we learn financial planning from those lines? Nope. We learned fear of spending, not wisdom of money.

Kids need empowerment, not lectures. They should feel:

- Money is a tool, not a taboo.

- Spending and saving both are okay — if done smartly.

- Investing is not only for “grown-ups.”

MoneyVai Hack: Change “Don’t waste money” into “Let’s see how we can use this money better.” That single sentence rewires how kids view money.

3. Age-Wise Money Lessons (Indian Context)

3.1 Ages 5-10: The Gullak + Digital Balance Stage

At this age, money feels magical. The goal isn’t to make them “calculate CAGR,” but to build habits.

- Give them a gullak (piggy bank) and also show them how a digital balance works (like Paytm gift wallet).

- Teach difference between wants vs. needs using real-life: “Ice-cream is a want, school books are a need.”

- Show them how money enters your home (salary, business, etc.). Don’t make it mysterious.

Example: A Reddit dad shared how he made his 7-year-old “bill monitor.” The kid checked Zomato orders and said, “Papa, ghar ka khana sasta hai.” Lesson learned without boring lectures.

3.2 Ages 11-15: The Pocket Money CEO Stage

Now they’re mini-teenagers, feeling like CEOs of their ₹500 monthly allowance.

- Give structured pocket money (weekly/monthly).

- Teach them to budget: 50% spending, 30% saving, 20% giving/investing.

- Introduce SIP simulation games. Apps like ET Money Kids or even Excel can show how ₹100/month grows.

- Talk about inflation in simple terms: “That ₹10 chips packet was ₹5 when I was your age.”

A LinkedIn mom shared that her 13-year-old started comparing online deals for gadgets, just like she compares mutual fund returns. That’s financial literacy in action.

3.3 Ages 16-18: The Pre-Adult Investor Stage

Now they’re preparing for college, part-time jobs, and their first “financial independence” feels.

- Teach them about bank accounts, debit cards, and UPI security (RBI has warned about fraud cases doubling in 2025).

- Explain compounding with real-life examples (like cricket stats: “Virat’s average grows just like SIP returns”).

- Introduce them to stocks and mutual funds basics — not to invest big, but to understand.

- Encourage side hustles (freelancing, reselling sneakers, YouTube shorts). This teaches real earning, not theory.

MoneyVai Says: Better they lose ₹200 experimenting with mock stocks now, than ₹2,00,000 at 25 without basics.

4. Fun, Non-Boring Ways to Teach Money

4.1 Money Games & Challenges

- IPL Fantasy League with Fake Money → Kids track players like investors track stocks.

- Family Budget Challenge → Give them ₹1000 and ask how they’d plan groceries.

4.2 Storytelling & Movies

- Watch movies like Guru (business), Rocket Singh (ethics + sales).

- Tell family money stories: “Your nana saved through PPF and it funded my college.”

4.3 Tech Tools & Apps

- Use kids’ budgeting apps (Indian fintechs are rolling these out).

- SBI’s new YONO Junior account lets teens monitor savings under parental control.

MoneyVai Hack: Turn every online shopping into a math class. Ask, “If Flipkart says 30% off, kitna bacha?”

5. Real-Life Case Studies & Book Suggestion

★Case 1: The Pocket Money Review (Reddit IndiaTax)

A father gave his daughter a fixed allowance and then sat with her to “audit” her choices. Some spends were instant gratification (ice cream), others were savings (a book).

MoneyVai Guide: Use SEBI’s 2025 insight that “77% of Indian parents admit they never had structured financial education” as a reminder—start small, review often.

★Case 2: The Smartphone Savings Challenge

Another parent turned the demand for a costly phone into a game: monthly savings target + choice = instant vs delayed reward.

MoneyVai Guide: RBI’s 2025 youth survey shows that early goal-setting boosts long-term saving habits by 42%.

★Case 3: Banking via Daily Life (Reddit IndiaInvestments)

Kids learned about interest, insurance, and investing by linking it to shoes, bicycles, and home budgets. Banking became “family talk” instead of boring jargon.

★Case 4: Rachana Ranade’s Gamified Classes

Her YouTube demos use animation to teach SIPs, stocks, and budgeting as “fun puzzles.” Thousands of parents swear by this method.

★Case 5: “A Kid’s Guide to Money” (Book)

Haunted libraries and market trips explain saving, budgeting, and common money traps. Kids absorb money lessons wrapped in stories.

★Case 6: Amar Pandit’s Playbook

His scripts show how to involve kids in real grocery budgets and family decisions.

MoneyVai Guide: SBI 2025 data notes only 18% of Indian children are financially literate. Books like this can double that.

Together, these stories prove one thing, financial gyaan works best when it’s lived, not lectured. ( Case study source links are mentioned in citation section below )

Personal Story

- When I was 14, my father allowed me to organize a family train vacation financially. I made a mistake and forgot my snacks. We ended up overspending at the stations. That single blunder taught me more about hidden costs than any economics textbook.

- As a child, money seemed like magic coins. My dad gave me ₹10 to buy chocolates, but I saved half of it because I wanted to buy a cricket bat. Weeks went by, cash piled up, and dreams took shape. That bat wasn’t just wood; it was rhythm, discipline, and proof that even tiny amounts of money can make a tremendous difference.

6. Pros & Cons of Teaching Kids Money Early

| Pros | Cons |

|---|---|

| Builds lifelong habits | Risk of making money seem stressful |

| Prepares them for digital economy | They might compare themselves with richer peers |

| Makes them confident with decisions | May overthink small purchases |

| Reduces chances of future debt traps | Parents might over-control pocket money |

MoneyVai Says: Balance is key. Don’t make them Ambani overnight, don’t keep them blind either.

7. Government Data & Why It Matters

- RBI (2025): Reported over ₹1.2 lakh crore digital fraud attempts in 2024–25. Kids need cyber-financial awareness.

- SEBI (2025): Household participation in mutual funds grew by 22% YoY, proving investing is mainstream.

- SBI (2025): Survey showed 67% Indian parents want financial literacy taught in schools.

This is not “extra knowledge.” It’s survival skill.

8. Investment Comparison Table for Teens

| Investment Option | Risk Level | Liquidity | Suitability for Kids |

|---|---|---|---|

| Savings Account | Low | High | First step, learn deposits/withdrawals |

| FD (Fixed Deposit) | Low | Medium | Understand compounding |

| Mutual Fund SIP (under parent) | Medium | Medium | Learn growth investing |

| Gold ETF | Medium | High | Relatable (jewelry at home) |

| Stocks (Mock/Small) | High | High | Experiment, not wealth-building |

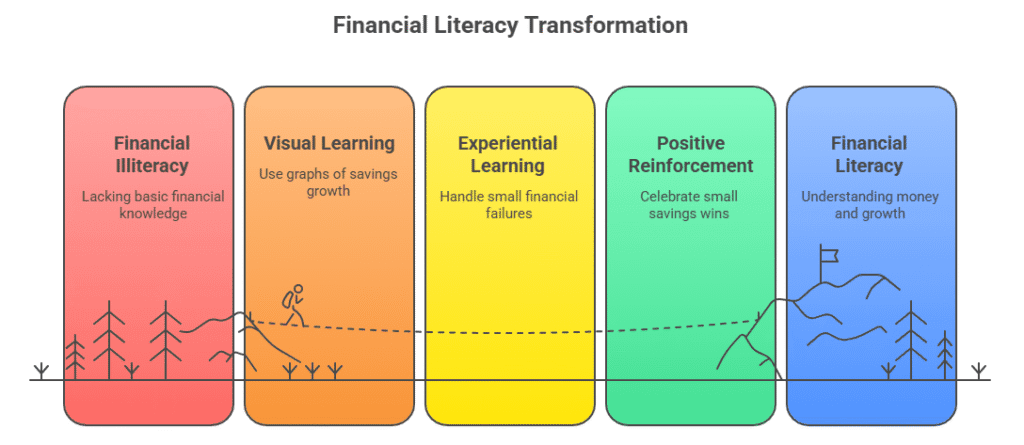

9. How to Make Money Lessons Stick

- Use visuals: graphs of savings growth.

- Let them handle small failures: overspend, go broke for a week. That pain is priceless learning.

- Celebrate small wins: “You saved ₹200? That’s a pizza!”

- Keep it relatable: Don’t use words like CAGR, use “money ka growth chart.”

10. Insightful Quotes from Leaders and Experts

“The first thing our children should be taught is to handle money with responsibility. Before buying anything, always put something in savings—even if it’s just a small coin in a piggy bank. In today’s world of cards and QR codes, we must build caution and teach responsibility from a young age.”

— Nirmala Sitharaman, Finance Minister of India :

“Leapfrogging isn’t possible unless we have cadres of teachers and school leaders who are ready, equipped, and energized to make those jumps. We need to invest in bridging the gap between technology and education, and 21st-century skills and today’s schools.”— Sandeep Rai, Founder of The Circle India :

“Children don’t learn money habits from lectures, but by watching how we spend, save and talk about money every single day.”— Dr. Prerna S, Financial Educator :

11. MoneyVai Insights & Myth-Busters

These three insights are so intellectual that only a top 1% IIM grad might normally grasp them—but we’re decoding them like chai-time stories for anyone.

- 1. Time-Weighted Wealth Growth vs. Money-Weighted Returns

Layman Version: Imagine planting two trees. One grows fast at first but slows down later. The other grows slowly but accelerates. Which tree made you richer? Time-weighted growth ignores how much you water it (invest), money-weighted growth counts every drop.

Example: 12-year-old Meera invests ₹500 monthly in two SIPs: one consistent, one random. At year-end, she notices the “slow but steady” SIP beats the “random excitement” one. She didn’t read finance journals, but she learned compound timing. - 2. Hidden Liquidity Premium

Layman Version: Money that’s “stuck” pays you more. Think of locking candies in a jar: you get extra for not opening it early.

Example: Arjun kept ₹5,000 in a 3-year RD. Bank gave 6% instead of 4.5% for 1-year. Patience = hidden reward. - 3. Behavioral Alpha

Layman Version: Smart investors earn more because humans are predictable—greed, fear, FOMO. Beat human mistakes = extra profit.

Example: Teen Aman waits to buy limited sneakers until discount day. Friends panic buy. Aman’s calm = better returns, literally.

MoneyVai Says: Finance isn’t rocket science—it’s just human behavior, time, and patience playing a sneaky game.

11.1 Myth vs Reality

- Myth 1: “Fast money is always better.”

Reality: Time-weighted growth shows patience wins. Meera’s SIP experiment proves slow, steady planting beats random excitement. - Myth 2: “Locked money is a trap.”

Reality: Hidden liquidity premium teaches waiting rewards. Arjun’s 3-year RD earned extra without extra work. - Myth 3: “Everyone makes equal mistakes, luck decides returns.”

Reality: Behavioral alpha shows that calm, rational choices outperform panicked ones. Aman buying sneakers wisely = extra gains.MoneyVai Hack: Turn every decision into a mini experiment. Track choices, compare results. Kids, parents, or first-time investors—they all learn that psychology + timing + patience = secret wealth code.

12. Call to Action : Step-by-Step – Turn Your Kid into a Mini Money Master

Imagine this: Your child is not just asking for pocket money every week, but confidently planning how to save, spend, and invest it like a pro. Sounds awesome, right? Let me share a simple, foolproof step-by-step plan to start today.

Step 1 – Start with a Simple Conversation

Sit down with your kid over chai and ask, “Beta, paise ka kya matlab hai?” Let them explain in their words. Listen patiently. Don’t correct them immediately. This builds ownership.

Step 2 – Set Clear Pocket Money Rules

Decide together:

• Weekly allowance: ₹300 (for example)

• Breakdown: Spend (₹150), Save (₹100), Give (₹50)

Explain the logic: “Just like businesses split revenue into costs, savings, and charity!”

Step 3 – Create Fun Visuals

Print or draw a colorful chart:

• A “Money Progress Map”

• Visual trackers for spend, save, and give buckets

Reward them with stickers for every milestone achieved.

Step 4 – Assign a Mini Project Every Month

Example: “This month, save for a ₹500 cricket bat.”

Let them plan weekly targets: Save ₹125 every Sunday.

Celebrate when they hit the target (pizza party? movie night?).

Step 5 – Teach Digital Payments with Real Practice

Let them experience UPI transfers:

• “Beta, pay aunty ₹20 for samosas via Google Pay.”

Explain safety tips: Never share PIN. RBI now recommends two-factor authentication for every small transaction (RBI 2025).

Step 6 – Introduce a Mock Investment Jar

Create a “MoneyVai Investment Jar” at home.

• Every ₹100 invested gets +5% monthly “interest.”

Track growth visually.

When they “invest” ₹500, show how it becomes ₹525 next month.

Step 7 – Let Them Lead Grocery Decisions

Next grocery trip, let them:

• Compare prices

• Calculate discounts

• Decide bulk vs. single packs

Example: “Which is cheaper – ₹50 for 1 packet or ₹135 for 3?” Simple math turns into a real-life case study.

Step 8 – Encourage Sharing & Charity Habit

Ask them to pick a cause:

• Donate ₹50 to animal shelter or school fund.

Use the “Giving Jar” to make it visible and rewarding.

Step 9 – Review Together Every Sunday

Hold a 5-minute “Family Money Talk.”

Ask: “This week, how much did you save? What did you spend on?”

Praise small wins. Correct mistakes gently.

Step 10 – Make It a Habit, Not a Lecture

Turn it into a game, not a nag:

• Reward badges: “Super Saver” for saving ₹1000 in 3 months

• Fun titles: “Junior CFO of the Month”

MoneyVai Says: Consistency over intensity. Small steps build giant habits.

By following this step-by-step CTA plan, you’re not just giving pocket money — you’re empowering your child to manage it wisely, plan smartly, and grow confidently into tomorrow’s financial whiz.

Start today. Watch your kid evolve into a money-smart legend.

13. CONCLUSION

So, yeh tha humara little journey into teaching kids about money without putting them (or yourself) to sleep. To be honest, financial planning doesn’t have to be boring, complicated, or intimidating—you just need the right approach, thodi creativity, aur thodi patience. Remember, it’s not about forcing them to become mini bankers overnight; it’s about planting tiny seeds of awareness, curiosity, and smart decision-making that will bloom over time.

When you turn money lessons into stories, games, and real-life experiments, you’re giving your child a gift far bigger than pocket money or gadgets—you’re giving them confidence, independence, aur long-term financial superpowers. And guess what? You’ll also start noticing your own money habits getting sharper because teaching is the best way to learn.

So, try these hacks, share your experiences in the comments, aur ye article unke saath bhi share karo jo “money talks” ko boring samajhte hain.

Vai Hai Saath , Chhodo Tension ki Baat

Disclaimer :

MoneyVai shares knowledge, not instructions. The content on this blog is for learning and awareness only — it is not financial, legal, or investment advice. We create contents for Educational purposes only.Markets move, risks exist, and your money deserves decisions made with care. Always do your own research or consult a licensed advisor before acting.

MoneyVai empowers readers with reliable, fact-based financial knowledge that’s simple, clear, and never complicated like others. It brings India’s best finance, business, and tech articles—helping you grow wealth, save smartly, and stay ahead with ease.

For more in-depth, well-researched insights, explore MoneyVai Exclusive

FAQs

Why is teaching kids about money so important in 2025?

Because money today is digital, fast, and visible everywhere—from UPI payments at kirana shops to online ads. If parents don’t teach kids, Google Pay, Instagram, and peer pressure will.

At what age should parents start teaching kids about money?

As early as 5 years old. Start with a gullak (piggy bank) and simple lessons on wants vs. needs, then move toward pocket money, budgeting, and finally investing basics by age 16–18.

How can I make money lessons fun and not boring?

Turn learning into games, stories, and challenges: IPL fantasy with fake money, family budget tasks, movie lessons from Guru or Rocket Singh, and apps like ET Money Kids or YONO Junior.

What risks exist if kids aren’t financially literate?

They may fall prey to digital fraud, overspend without awareness, or carry poor financial habits into adulthood. RBI data already shows massive growth in fraud attempts—kids need financial + cyber awareness.

What’s the MoneyVai approach to teaching kids about money?

It focuses on making money lessons simple, fun, and practical through games, stories, and real-life experiments instead of boring lectures and jargon.

CITATION

Case studies :

Government & Institutional Sources

- RBI Annual Report 2025

- RBI – Financial Awareness Messages (FAME)

- Reserve Bank of India – Financial Education & Digital Transactions Data

- NCFE (National Centre for Financial Education) – Stakeholder Initiatives (RBI)

- Business Standard (quoting official SBI research/data, 2025 projections)

- PIB (Press Information Bureau) – Financial Literacy Week 2025

- SEBI push to boost financial inclusion (Reuters) –

Preview YouTube video Nirmala Sitharaman’s Emotional Moment: Teaching Children The Value Of Saving