Should You Buy Warranty or Not? The Truth Behind Extended Warranties

Table of Contents

Introduction

Imagine this: You’re at a wedding buffet. Plates are loaded, gulab jamuns shining like gold coins, and just as you’re about to dig in—bam! The caterer whispers, “Sir, sirf ₹500 extra and if anything goes wrong with the food, you’ll get replacement instantly.” You laugh, right? Because who buys “extended warranty” on gulab jamuns? But when it comes to cars, mobiles, or laptops – we nod and swipe the card without thinking twice.

Here’s the reality. According to RBI’s 2025 Consumer Protection Framework, Indians spent over ₹15,000 crore last year on extended warranties. To put that in perspective, that’s almost equal to what SBI reported people transacted via UPI in a single week. Matlab, paisa bachane ke liye bhi hum paisa uda dete hain.

This is exactly where the MoneyVai approach comes in-practical, witty, and no-nonsense. Think of it as financial planning in chai-sutta language: smart hacks, expert-level insights, and relatable stories but totally Jargon free ( we don’t do that here). Ready to decode the truth?

Unlike random WhatsApp forward, this guide is powered by official and trusted sources. This is the backbone of MoneyVai : T R U S T .

1. What Exactly Are Extended Warranties?

Extended warranty is that shiny add-on sellers pitch like it’s a magic shield. In reality, it’s an overpriced insurance for “what if” repairs that might never happen. Instead of paying extra, park that money in your own emergency jar. Extended warranties are sold as a safety net — an insurance-like cover that promises “peace of mind” after your product’s standard warranty ends. MoneyVai Says: “Why buy fear today for a problem that may never knock tomorrow?”

- Manufacturer Warranty (free) → Typically 1 year.

- Extended Warranty (paid) → Extra 1–5 years, covering selected repairs.

Types of Extended Warranties You’ll Usually Face

- Manufacturer Extended Warranty – Directly from the brand, often with better service but higher cost.

- Retailer/Dealer Warranty – Add-on sold at the store, sometimes with more exclusions than inclusions.

- Third-Party Warranty – Independent providers; cheaper but tricky with claim approvals.

- Service Contract Plans – Covers repairs, maintenance, sometimes accidental damage too.

- Bundled Warranties – Packaged with credit cards, banks, or EMI schemes, often hidden in fine print.

Sounds simple, right? But here’s the twist: according to IRDAI (2025), warranties are “service contracts, not insurance”. Still, they work on the same math as insurance: collect money from many, pay only a few.

MoneyVai Says: If you’ve ever wondered why salespeople push warranties harder than the phone itself, it’s because the margins are sweeter than rasgulla in Bengal.

2. The Indian Warranty Market: Numbers You Shouldn’t Ignore

According to Consumer Affairs 2024 study and industry reports 2025:

- India’s extended warranty market in 2024 = USD 4.0 billion.

- Expected by 2033 = USD 9.0 billion.

- CAGR growth = ~10% annually.

- Biggest drivers → rising urban incomes, gadget addiction, and consumer fear of inflation in repair costs.

Translation: The warranty industry is growing faster than your Ola surge prices. And who’s paying for this growth? You.

3. Repair Costs in 2025: The Real Picture

Here’s where the math bites.

| Item | Average Repair Cost (2025, India) | Warranty Cost (Approx.) |

|---|---|---|

| Smartphones (₹60k+) | ₹7,000–15,000 (screen/battery) | ₹6,000–12,000 |

| Laptops (mid–high end) | ₹8,000–20,000 | ₹7,000–10,000 |

| Refrigerators/ACs | ₹2,500–7,000 | ₹3,000–8,000 |

| Cars (regular annual maintenance) | ₹5,000–15,000 | ₹10,000–25,000 (extended cover) |

| EV Battery Replacement | ₹55,000+ | ₹12,000–18,000 |

RBI July 2025 Data: CPI inflation is 1.55%, but spare parts inflation is 5–8% annually. That means warranty prices are inflated far beyond general inflation.

MoneyVai Hack: If the warranty cost itself = almost the repair cost, better to keep money aside than lock it with the company.

4. How Many People Actually Use It?

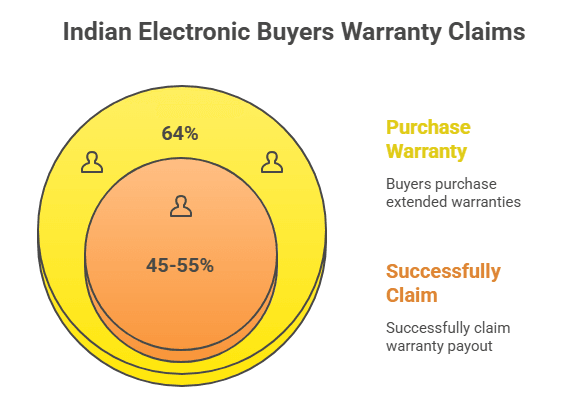

Numbers that surprise most buyers:

- 64% of Indian electronic buyers purchase extended warranties.

- But only 45–55% claim successfully.

- For cars, only 10–20% claims succeed.

- Consumer Affairs 2024 → 60–70% of warranty price is pure profit for retailers/administrators.

Quick Snapshot: Warranties vs. Investments in 2025 (India)

| Category | 2025 Spend / Returns | Key Insight |

|---|---|---|

| Extended Warranties | ₹15,000+ crore (RBI Data) | Money locked in “what if” protection. |

| Equity Mutual Funds (SIP inflows) | ₹18,800 crore/month (SEBI Data) | Real wealth creation vehicle. |

| SBI Retail Term Deposits | ₹12,000 crore/month (SBI Report) | Safer, steady 6–7% yearly growth. |

MoneyVai Says: Every rupee spent on warranties is a rupee not compounding in your FD, SIP, or stock portfolio. That’s like buying “insurance” for gulab jamuns instead of investing in a thali that feeds you for life.

In other words: warranties are like gym memberships. Lots of sign-ups, very little usage.

5. Case Studies That Tell the Real Story

5.1 Case Study 1: When Warranty Saved the Day (Reddit – r/gmcsierra)

A Redditor with a $100,000 Duramax ZR2 truck went all-in on a $2,500 extended warranty for a 10-year loan period. Big gamble? Maybe. But when costly repairs hit, the warranty covered everything—like a financial shield in an Avengers movie. Instead of sleepless nights over ₹10-lakh-equivalent repair bills, he was chilling.

MoneyVai Says: For high-value machines with repair costs that can break your FD, an extended warranty is less an “extra” and more a financial seatbelt.

5.2 Case Study 2: The RAV4 Reality Check (Reddit – r/rav4club)

One Toyota RAV4 buyer dropped $1,600 on an extended warranty, only to realize later—it added just 2 years and 15,000 miles beyond the existing coverage. Matlab, it was like paying for a Netflix subscription and getting only 2 extra episodes. They even considered canceling it.

MoneyVai Hack: Always compare what you’re already getting (manufacturer warranty) vs. what’s actually extra. Small print is where money vanishes faster than Maggi boils.

5.3 Case Study 3: LinkedIn Wisdom – The Market Boom

A financial advisor on LinkedIn dropped a bomb: India’s automotive warranty market is growing at 10% CAGR (2025). Why? Rising vehicle prices + expensive repairs = people paying for peace of mind. The post also cited RBI’s consumer protection guidelines, which are tightening rules to protect buyers from shady warranty traps.

MoneyVai Insight: Don’t just see warranty as a cost—see it as part of your personal risk management portfolio, just like insurance. But jaise SEBI kehta hai—“Read documents carefully before investing,” yahan bhi wahi funda hai.

5.4 Case Study 4: Strategic Hack from LinkedIn

A LinkedIn pro shared how they negotiated dealer pricing on a truck warranty and bagged a sweet deal. Best part? The warranty had a prorated refund clause—if they sold the vehicle early, they’d get money back. Matlab, not just protection but resale juice bhi!

MoneyVai Says: Negotiation is not “bargaining aunty” behavior—it’s wealth preservation. Always ask: What’s the exit plan? Refund? Transferable? Warranty tabhi smart hai jab flexibility included ho.

5.5 Case Study 5: My Own Brush with Warranty Dilemma ( My Story )

I still remember standing at the billing counter, heart thumping, when the salesman leaned in with that classic pitch: “Sir, sirf ₹7,000 extra and you’ll never worry about repairs.” My new laptop was gleaming on the table, and my brain was torn. One side whispered, “Peace of mind.” The other yelled, “Arre, 7k se ek mutual fund SIP start kar le!”

Three months later, the laptop’s battery went kaput—repair cost ₹6,800. Warranty would’ve saved me. But here’s the twist: I had already built a small Emergency Tech Fund (MoneyVai hack alert). I paid without blinking, no EMI stress, no warranty regrets.

MoneyVai Says: That day I learnt—warranties are not always bad, but building your own cushion is like wearing an invisible armor. No salesman can sell you fear once you hold your own safety net.

Note : ( Case study source links are mentioned in citation section below )

6. Pros & Cons of Extended Warranties

| Pros (Why it feels safe) | Cons (Why it’s often a trap) |

|---|---|

| Peace of mind, especially for expensive products. | High upfront cost (₹2k–₹20k). |

| Covers high-ticket failures (gearbox, EV battery). | Claim approval is tough (hidden exclusions). |

| Inflation makes future repairs costly. | Retailer profit margins = 50–80%. |

| Good for people who don’t have emergency savings. | You might never use it (low claim probability). |

MoneyVai Says: If the product’s failure can financially shock your budget (like EV battery), consider it. Otherwise, skip.

7. Government’s Stand in 2025

7.1 Few eye opening Govt’s Stats :

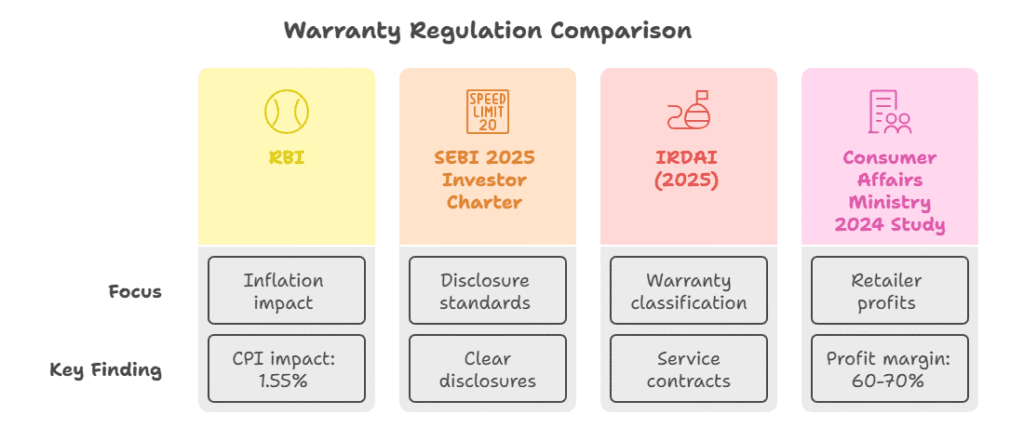

- RBI → July 2025 CPI inflation = 1.55%, but repair inflation = 5–8% annually.

- SEBI 2025 Investor Charter → Pushes for clear disclosures in all financial contracts. Warranties now must list inclusions & exclusions upfront.

- IRDAI (2025) → Classifies warranties as “service contracts,” but regulates overlaps with insurance.

- Consumer Affairs Ministry 2024 Study → Retailers keep 60–70% of warranty price as pure profit.

Bottom line: Rules now protect your rights better, but math still protects retailers’ margins.

7.2 Straight from the SARKAR

- “We shall strive to foster a culture of continuous improvement in customer services and strengthening customer protection.” — RBI Governor, 2025. : Financial Express

- “Unless the ecosystem moves beyond check-box compliance and arms investors with tools and information to hold corporate decision-makers accountable, that trust could falter.” — SEBI chairman Tuhin Kanta Pandey, 2025. : Caalley

- “It should not be the case that the consumer comes to know about the details of the warranty after she/he has purchased the product.” — Nidhi Khare, Chief Commissioner, CCPA, 2024. : Economic Times

8. Opportunity Cost: Warranty vs Investment ( MoneyVai Math )

Let’s checkout from viewpoint of a Mathematician but in a Realistic MoneyVai way that you can relate. Welcome to MoneyVai Math. Even i can lie , but mathematics can’t !!

Case 1 : The Simple Math That Says “Don’t Buy”

- It’s a Bet: An extended warranty is a bet you place against the retailer. You bet ₹5,000 that your new appliance will break.

- The House Always Wins: Retailers use vast data. They know only a small percentage of products (e.g., 5%) will need a major repair during the warranty period.

- The Expected Cost: For a ₹60,000 TV with a 5% failure rate and an average repair cost of ₹15,000, the store’s expected cost per customer is just ₹750 (5% x ₹15,000).

- The Massive Markup: They charge you ₹5,000 to cover this ₹750 risk. This is a huge profit margin for them.

- Your Probable Outcome:

- 95% Chance: Your product doesn’t break. You lose your entire ₹5,000 bet.

- 5% Chance: It breaks. You “win” by avoiding a ₹15,000 repair, but you still paid ₹5,000, so your net gain is only ₹10,000.

- MoneyVai Says : Statistically, you are guaranteed to lose money over time. The odds are meticulously calculated in the retailer’s favor, making it a poor financial bet for you.

Case 2 : Suppose you buy a ₹10,000 extended warranty for a laptop for 3 years.

- Average laptop repair cost probability = 20%.

- Average repair bill = ₹12,000.

- Expected saving = 20% × 12,000 = ₹2,400.

- Net expected loss (since you paid ₹10,000) = -₹7,600.

What if you invested that ₹10,000?

| Option | Value After 3 Years |

|---|---|

| Extended Warranty | Expected loss = -₹7,600 |

| RBI Bonds @ 8.05% (2025 rate) | ₹12,600 |

| SBI RD (5-year flexible) | ₹12,000–12,300 |

MoneyVai Hack: For gadgets under ₹50k, skip warranty and park money in RBI bonds. For cars/EVs, weigh risk vs. repair cost.

9. The Psychology Behind Buying Warranties

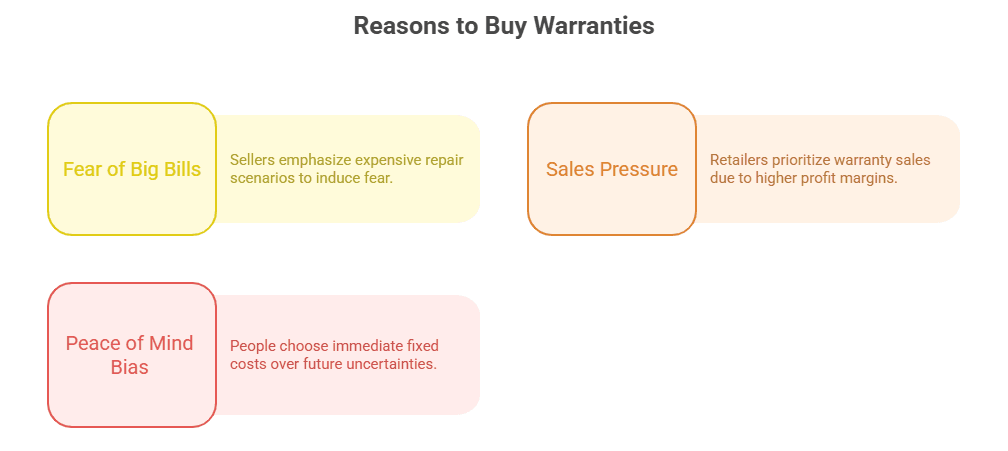

Why do we fall for warranties?

- Fear of Big Bills → Seller reminds you of ₹50,000 repair horror stories.

- Sales Pressure → Retailers earn more margin on warranty than the product itself.

- Peace of Mind Bias → We prefer fixed cost today over uncertain cost tomorrow.

But as one Reddit user said: “Extended warranty is paying to sleep better, not necessarily paying to save money.”

MoneyVai Says: Build an emergency fund → that’s peace of mind + financial logic.

10. MoneyVai Hacks to Outsmart Warranties

- Negotiate Price – Warranties have 50–80% margins. Always bargain.

- Credit Card Benefits – HDFC Infinia, SBI Elite double manufacturer warranty for free.

- Insurance Alternative – Gadget/vehicle insurance often cheaper and broader.

- Emergency Fund Strategy – Instead of warranty, create a “repairs-only FD.”

- Check RBI-Approved Add-Ons – Safer, regulated, and cheaper.

11. A Simple Decision Framework

Ask yourself these questions before saying yes:

- Is the product value above ₹50,000?

- Can I pay from pocket if it breaks tomorrow?

- Is the repair cost > warranty price × 3?

- Does my credit card already cover it?

If answers lean toward Yes, skip warranty. If No (e.g., EV battery), consider buying.

12. MoneyVai Special Insights & Myth-Busters

Finance is not just about numbers, dost—it’s about psychology, timing, and invisible forces. Let me break down three mind-bending insights in the most “chai tapri” language possible:

- Opportunity Cost is the Silent Killer

Every ₹5000 EMI you commit to today is not just money spent—it’s money that could’ve grown into ₹50,000 if invested. Like skipping gym: the fat doesn’t show instantly, but after 2 years, you’ll regret every missed workout. - Liquidity > Returns

Imagine you’re stuck at a wedding buffet. Amazing biryani, gulab jamun, but the counter only accepts Paytm—and your phone is dead. Assets are the same: What’s the point of 15% return on paper if you can’t access cash in an emergency? - Hidden Asymmetry in Risk

Small mistakes hurt more than small wins help. Break your phone screen once, it’s ₹10,000 gone. Save ₹500 on discount coupons? Feels good, but doesn’t change life. That’s why protecting downside is smarter than chasing upside.MoneyVai Says: Real finance is less about earning “extra” and more about avoiding the silent killers.

12.1 Myth vs Reality

Myth: “High salary automatically means wealth.”

Reality: Wealth is built by how much you keep, not how much you earn. A Reddit user once shared—he earned ₹2 lakh/month but ended broke because he upgraded lifestyle faster than income.

Myth: “Debt is always bad.”

Reality: Debt used smartly is leverage, not poison. A LinkedIn professional admitted he used a personal loan at 11% to clear a credit card debt at 36%—smart juggling saved him from financial quicksand.

Myth: “Savings = Sacrificing happiness.”

Reality: Nahi bhai, savings is buying future freedom. Like skipping one weekend trip today so you can afford a world tour tomorrow. A Quora user explained how his emergency fund allowed him to quit a toxic job without fear.MoneyVai Says: Finance myths sell comfort. Reality sells freedom. Choice is yours.

13. Call to Action

Listen dost, extended warranty lena ya na lena is not about “status” or “peace of mind.” It’s about smart decision-making. Before signing that dotted line:

- Check Product Risk: Gadget fragile hai ya tank-like strong?

- Cost vs. Repair: Warranty cost > future repair? Mat le bhai.

- Usage Style: Careful driver or “F1 racer” with appliances?

- Financial Cushion: Can you self-insure from an emergency fund?

- Manufacturer’s Trust Factor: Brand ka asli track record dekho, not marketing bhashan.

MoneyVai Says: Warranty tabhi lo jab logic, not fear, backs it.

14. CONCLUSION

So yaar, extended warranty is like that extra chutney packet in Swiggy order—tempting, overhyped, and 9 out of 10 times, you don’t really need it. The truth? Companies sell you fear insurance, not financial wisdom. Real wealth planning isn’t about chasing safety nets everywhere; it’s about knowing where to save, when to spend, and how to self-insure with your own emergency fund.

MoneyVai Says: Stop outsourcing your peace of mind to “terms & conditions.” Outsource it to your own financial discipline.

Now, I want to hear from you. Have you ever bought an extended warranty and regretted it? Or maybe it saved you big bucks? Drop your story in the comments—let’s turn this into a mini consumer hall of fame (or shame ).

And hey, if this blog reminded you of your friend who buys warranty on even a toaster, share it with them. Unka enlightenment zaroori hai.

Vai Hai Saath , Chhodo Tension ki Baat

MoneyVai empowers readers with reliable, fact-based financial knowledge that’s simple, clear, and never complicated like others. It brings India’s best finance, business, and tech articles—helping you grow wealth, save smartly, and stay ahead with ease.

For more in-depth, well-researched insights, explore MoneyVai Exclusive

FAQs

1. Why do companies push extended warranties so aggressively?

Because warranties are like insurance where the house always wins—companies earn huge profits since most people never use them.

2. Are extended warranties ever financially smarter than self-insuring?

Rarely. Only when the product has high repair costs and a history of failure, like certain high-end electronics or cars.

3. How do warranties impact long-term financial planning?

Small recurring warranty purchases quietly drain your budget. Self-insurance (emergency fund) compounds into real wealth.

4. Is there a psychological bias behind buying warranties?

Yes. Behavioral finance shows “loss aversion”—we fear a ₹10,000 loss more than we enjoy a ₹10,000 gain—so we overpay for peace of mind.

5. Can warranties ever be a strategic move in business or investing?

Yes. Businesses sometimes buy warranties to ensure uptime (e.g., laptops for employees). Here, warranty is not about fear, but about minimizing downtime cost.

CITATION

Case Study Section

Government’s Source

- MoSPI press release on CPI for July 2025

- MoSPI release page for CPI July 2025

- PIB press release publishing MoSPI’s CPI July 2025 data and notes.

- SEBI circular issuing Investor Charter for Stock Brokers

- SEBI circular issuing Investor Charter for Research Analysts

- IRDAI press release on Master Circular: Protection of Policyholders’ Interests

- PIB press release on Department of Consumer Affairs regional workshop (June 13, 2025)