Should You Invest in Crypto for the Long Term in India? The MoneyVai Way

Table of Contents

Picture this:

It’s evening coffee with your best friend, and the conversation quickly swings from IPL scores to Bitcoin.

Someone says, “Bro, cryptocurrency is the new gold!”

While the other laughs, “Arrey, RBI toh roz bolta hai; it’s risky.”

Who is right?

Welcome to the most heated financial argument of 2025.

Here’s the reality:

India is no longer ignoring cryptocurrency.

The RBI reports that about 12 million Indians invested in digital assets in 2024.

However, SEBI has stated that regulated companies such as mutual funds cannot now engage in crypto trading.

What about the buzz?

It is louder than ever.

And now comes the big question:

Should cryptocurrency be included in your long-term portfolio, or is it simply digital gambling disguised as technical jargon?

That’s where the MoneyVai approach kicks in:

Simple, smart, and actionable.

No jargon, no boring textbook finance.

Just relatable, witty hacks that even your dadi would nod along to.

Think of it as financial planning, but in a way where long-term wealth, discipline, and common sense still matter more than FOMO.

MoneyVai Says: Don’t let crypto buzz cloud your common sense; real growth takes patience and planning.

Ready?

Let’s cut through the noise and see if crypto deserves a seat at your investment table.

Unlike random WhatsApp gyaan, this guide is powered by official government, RBI, PIB, and trusted sources. This is the backbone of MoneyVai : T R U S T.

1. The Curious Case of Indian Investors and Crypto Dreams

Let me tell you a story.

Amit, a close buddy who works in an IT firm in Pune, once told me over chai that he bought Bitcoin in 2017 for ₹2.5 lakh. Everyone labelled me insane. Today, despite the ups and downs, my portfolio is still 5x higher. What about the stress? “Arre, my blood pressure went up more than the Sensex!”

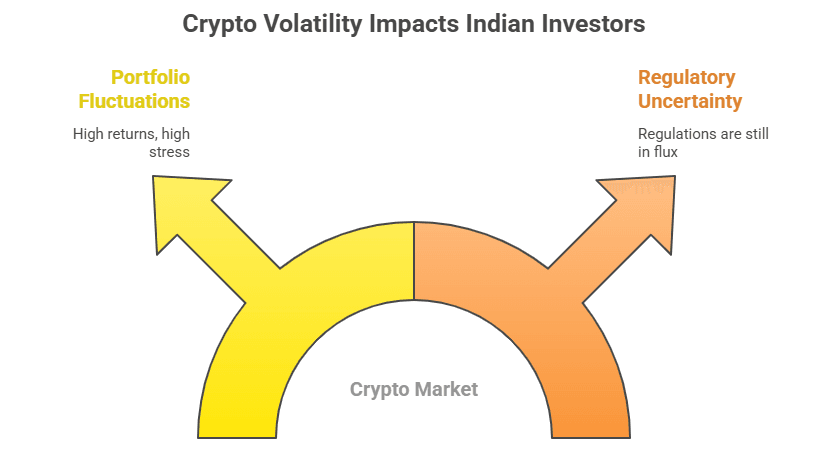

That is at the heart of India’s cryptocurrency dilemma: it is about resilience as much as returns.

India today has over 115 million crypto users (as per 2025 reports from major exchanges), making it one of the largest crypto-holding nations globally. And yet, regulations are still in flux. Unlike FD or PPF where you sleep peacefully, crypto is that unpredictable friend who can make you a star one day and ghost you the next.

2. Understanding Crypto in India’s Financial Planning Landscape

2.1 Where Crypto Stands vs. Traditional Assets

| Investment Option | Average Annual Return (2020–2025) | Risk Level | Liquidity | Tax Treatment in India (2025) |

|---|---|---|---|---|

| Fixed Deposit (FD) | 6–7% | Very Low | High | Taxable under slab |

| Public Provident Fund (PPF) | 7.1% (as per SBI 2025) | Very Low | Low (15 years lock-in) | EEE (Tax-Free) |

| Equity Mutual Funds | 12–15% | Moderate | High | LTCG @10% beyond ₹1 lakh |

| Real Estate | 8–10% | Moderate-High | Low | Stamp Duty + LTCG |

| Crypto Assets (Bitcoin, ETH, others) | 40–70% (5-year CAGR but highly volatile) | Very High | Very High | 30% flat tax + 1% TDS (as per Union Budget 2025) |

Now, clearly crypto beats all others in raw returns. But as every MoneyVai reader knows: Return without Risk = Myth.

2.2 SEBI, RBI & Government’s 2025 Stance

- RBI 2025: Still maintains that crypto is not a legal tender but has allowed regulated platforms to operate with strict KYC.

- SEBI 2025: Working on a draft framework to bring crypto under “Digital Asset Investment Schemes.”

- Income Tax Dept.: Retains 30% tax on profits + 1% TDS on transactions above ₹10,000.

So technically, crypto is not illegal, but it’s not fully embraced either. Think of it like that relative who shows up at family functions uninvited but everyone still takes selfies with them.

3. Case Studies: Real Indians, Real Crypto Lessons (2020–2025)

Crypto looks sexy on charts, but behind every “6x return” is a human story of patience, panic, and jugaad. Let’s decode three real-life tales of Indians who dived into the crypto ocean—and came out with scars and wisdom.

3.1 The Sleepless Investor – “RichDad999” (Reddit)

In 2020, he moved ₹2 lakh from stocks to Ethereum. By 2025—boom!—it grew nearly 6x. But his confession is the real gem: “I learned to set alerts, not check prices daily, and stick to ETH/BTC.” Translation? Crypto gives returns, but also insomnia if you treat it like a casino.

Source : Reddit

3.2 The Systematic Player – Sumit Gupta (CoinDCX Co-founder)

Instead of lump sums, he played the SIP game—small bites of BTC, ETH, and Polygon, all within India’s KYC/tax net. His mantra: discipline + patience. That’s the desi way of “don’t chase the wave, ride it.”

Souce : Reddit

3.3 The Salary Converter – Shuhaib Shariff (LinkedIn)

A fintech founder who turned stablecoin salaries into Bitcoin during dips. His 45% gain in 2 years came with this nugget: “Treat every crypto bonus like ESOPs—enjoy upside, don’t gamble basics.”

Source : Linkedin

3.4 My Own Take – The Missed Ethereum Train

In 2019, I hesitated to buy Ethereum at ₹12,000, thinking it was overpriced. By 2021, it hit ₹3.5 lakh. Regret? Sure. But the real lesson: don’t chase hype blindly. Set a system, or you’ll always feel late.

MoneyVai Takeaway: Crypto success isn’t about luck—it’s about system, sanity, and staying in the game when others rage quit.

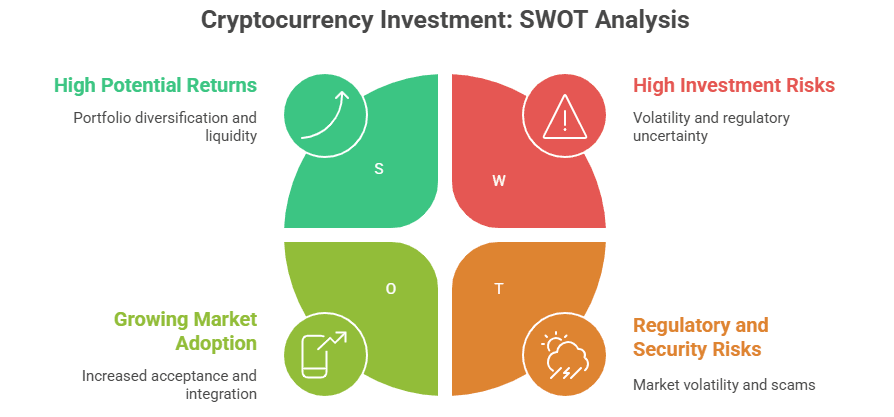

4. Pros & Cons of Long-Term Crypto Investing in India

| Pros | Cons |

|---|---|

| Potentially massive returns (Bitcoin’s 5-year CAGR >60%) | Extremely volatile (20–30% swings in days) |

| Hedge against rupee depreciation & inflation | No intrinsic value like FD interest or rental income |

| Growing adoption (startups, global funds) | Unclear regulations; RBI still skeptical |

| 24×7 trading, high liquidity | High taxes (30% flat, no deductions allowed) |

| Portfolio diversification (low correlation with stocks) | Risk of hacking, scams, and poor investor protection |

MoneyVai Hack: Always keep crypto exposure below 10% of your portfolio. That way, it’s an accelerator, not a derailment.

5. The Psychology of Crypto: Why Indians Love It

Crypto in India is not just about finance — it’s also about aspiration. For many young Indians, buying Bitcoin feels like “owning a ticket to the future.”

Reddit user insight: “My parents bought LIC policies; I buy ETH. Both are about security, just in different ways.”

See the generational gap? While older folks trust guaranteed returns, Gen Z and Millennials are okay with volatility because they see upside in disruption.

6. Long-Term Strategies for Crypto Investment

6.1 SIP in Crypto

Yes, it exists! Platforms allow you to auto-invest ₹500 weekly in Bitcoin or ETH. This smooths out volatility.

MoneyVai Says: SIP is like chai — one cup won’t matter, but daily habit builds comfort.

6.2 Diversification within Crypto

Don’t put all eggs in one basket:

- 50% in Bitcoin (store of value)

- 30% in Ethereum (smart contracts)

- 20% in emerging altcoins (Solana, Polygon)

6.3 Exit Strategy

Set rules. Example: “If Bitcoin doubles, I’ll book 25% profit.” That way, you don’t become greedy and lose out.

7. Comparative Table: Crypto vs. Equity for 10-Year Horizon

| Factor | Equity Mutual Funds | Crypto |

|---|---|---|

| Historical CAGR (10 years) | 12–15% | 40–70% (but inconsistent) |

| Regulation | Strong (SEBI regulated) | Weak/Unclear (RBI cautious) |

| Risk | Moderate | Very High |

| Tax | LTCG 10% beyond ₹1 lakh | 30% flat + 1% TDS |

| Peace of Mind | High | Low (volatility-driven stress) |

| Potential Wealth Creation | High | Extremely High (if held long) |

8. What the Future Holds for Crypto in India (2025–2030 Outlook)

- RBI 2025 Digital Rupee Experiment: With the Digital Rupee, RBI wants to ensure crypto doesn’t destabilize the economy but co-exists with CBDC.

- SEBI’s Possible Regulation: Likely to categorize crypto exchanges like stock brokers.

- Youth Adoption: A SBI 2025 survey found that 42% of investors under 30 in India want crypto as part of their portfolio.

- Institutional Entry: Mutual funds may soon launch “Digital Asset Funds” pending SEBI approval.

So, the train isn’t stopping — but whether you board it depends on your risk appetite.

8.1 Straight from the SARKAR

1. RBI Governor Sanjay Malhotra on Crypto Risks

“There is no new development following the Supreme Court pronouncement on the crypto matter. RBI has maintained a consistent stance on this issue. A government committee is currently examining the matter. We remain concerned about the potential risks crypto poses to financial stability and monetary policy.” Times of India

— RBI Governor Sanjay Malhotra, June 2025

This statement underscores the Reserve Bank of India’s cautious approach towards cryptocurrencies, emphasizing concerns over financial stability and the need for further examination.

2. Finance Minister Nirmala Sitharaman on Crypto Taxation

“The government has decided to maintain the 30% tax rate on cryptocurrency income and the 1% TDS on cryptocurrency transactions, which were implemented in July 2022.”

— Finance Minister Nirmala Sitharaman, February 2025

This reflects the government’s stance on cryptocurrency taxation, aiming to regulate the sector while ensuring compliance. Business Today , Mint

3. SEBI Chairman Tuhin Kanta Pandey on Digital Asset Exposure

“SEBI-regulated entities (such as mutual funds and alternative investment funds) are currently not permitted to have exposure to digital assets.”

— SEBI Chairman Tuhin Kanta Pandey, 2025

This highlights the Securities and Exchange Board of India’s position on digital assets, restricting regulated entities from investing in them.Global Practice Guides

9. 3 MoneyVai Insights & Myth-Busters

Ever wondered why some people seem to make money while others break their heads over the same investments? Here are 3 MoneyVai insights that even most seasoned investors miss—but explained like I’m telling you over chai.

- 1. The Time-Weighted Mindset

- Most investors track gains month-to-month. MoneyVai says: ignore that. Think in time-weighted returns. Imagine two friends, Raj and Meena. Raj invests ₹1 lakh in a startup that slowly grows over 7 years. Meena invests ₹1 lakh in a volatile crypto that spikes 100% in a month, then crashes 90%. Who’s richer long-term? Raj. Patience compounds better than hype.

- 2. Hidden Opportunity Cost of Cash

- Keeping ₹5 lakh idle in savings? You’re literally burning potential. MoneyVai insight: calculate what your money could earn if invested intelligently. Like renting out a spare room: idle space is lost income. Idle cash is lost wealth.

- 3. Behavioral Leverage

- Your own psychology is a bigger asset than any stock tip. People panic-sell; few hold. MoneyVai Hack: automate investments with small SIPs. Your future self benefits while your present self avoids drama.

MoneyVai Says: True financial mastery isn’t just knowing assets, it’s understanding time, opportunity, and yourself.\

9.2 Myth vs Reality

- Myth 1: “More money in hand = more security.”

- Reality: Idle cash is like a parked car eating fuel without moving. Take Sunil from Ahmedabad—he kept ₹3 lakh in savings for 5 years. Meanwhile, a ₹50k micro-SIP in a liquid fund gave him ₹90k extra. Lesson: money grows only when it works.

- Myth 2: “Quick wins define smart investing.”

- Reality: Instant spikes often lead to instant crashes. Priya, a college student from Jaipur, jumped on a trending fintech IPO, doubled her money in a week, then lost half in a day. Long-term, disciplined investment beats adrenaline-driven trading.

- Myth 3: “You can control market outcomes with knowledge alone.”

- Reality: Behavioral leverage matters more. Raghav from Pune automated ₹2,000 monthly in ETFs for 3 years. He didn’t panic during 2024’s market wobble and ended up 30% ahead.

MoneyVai Says: Understanding psychology, time, and opportunity separates casual investors from wealth builders.

10. Call to Action – Step by Step : Should You Invest?

Let’s cut through the noise and confusion like your favorite chai cutting through the morning fog. Crypto isn’t for everyone, but if you follow this simple, systematic approach, you’ll stay sane while still catching its upside.

Step 1 – Fix Your Financial Foundation First

Before even thinking about crypto, make sure your basics are rock solid:

- Emergency Fund: Cover 6–12 months of expenses in a safe place (like Fixed Deposits or Savings Account).

- Insurance: Health + Term Life insurance in place.

- Retirement Savings: Regular contributions to PPF or NPS.

MoneyVai Says: Crypto is a satellite, not the core of your financial universe.

Step 2 – Decide Your Crypto Investment Amount

Here’s a simple rule of thumb:

- Allocate 5%–10% of your investable surplus toward crypto.

- Example: If you have ₹10 lakh invested in mutual funds + FDs, keep ₹50,000–₹1 lakh in crypto.

Don’t bet your future house rent on crypto volatility. Treat it like investing in a startup — high risk, high reward, but don’t go overboard.

Step 3 – Pick the Right Crypto Assets

Forget the hype and influencer shilling. Focus on blue-chip coins:

- Bitcoin (BTC) – Store of value

- Ethereum (ETH) – Smart contract king

- Solana (SOL) – High-speed transactions

Allocate like this:

- 50% Bitcoin

- 30% Ethereum

- 20% Emerging coins (like Polygon, Solana)

MoneyVai Hack: Use RBI/SEBI-registered exchanges like CoinDCX Pro or WazirX to avoid scams.

Step 4 – Use Crypto SIP (Systematic Investment Plan)

Instead of lump-sum buys, create discipline.

- Set up ₹1,000–₹5,000/month auto-invest in Bitcoin or Ethereum on trusted platforms.

- Why? It averages out volatility, like buying vada pav every day instead of stockpiling them.

MoneyVai Says: SIP smooths out the rollercoaster ride, making long-term wealth building less stressful.

Step 5 – Ensure Secure Storage of Your Crypto

Never leave big holdings on exchanges. Follow this hierarchy:

- Small amounts (<₹10,000): Keep on regulated exchange wallet.

- Large holdings (>₹1 lakh): Transfer to cold wallets (Ledger Stax, Trezor).

Backup your 12-word recovery phrase in multiple safe places. Forget it, and you’ll lose access forever.

MoneyVai Hack: Think of your cold wallet as your bank locker; don’t share the key with nosy relatives.

Step 6 – Plan for Taxes in Advance

Indian taxation is harsh:

- 30% flat tax on profits (Income Tax Act, 2025).

- 1% TDS on every transaction above ₹10,000.

Solution:

- Use platforms like Koinly or ClearTax to auto-generate tax reports.

- File Schedule VDA with your ITR annually.

MoneyVai Says: Don’t let the taxman snatch your crypto gains because of ignorance.

Step 7 – Monitor but Don’t Obsess

Your crypto portfolio doesn’t need constant stalking. Instead:

- Set price alerts on CoinDCX.

- Rebalance quarterly (reduce Bitcoin if it grows too large).

Pro Tip: Avoid WhatsApp “Crypto tips groups” — 90% of those tokens crash within days.

Step 8 – Know When to Exit

Set exit strategies in advance:

- Example: If Bitcoin doubles in value, sell 25% to book partial profits.

- Example: After 5 years, shift part of your crypto gains to real-world assets (FD, Gold, etc.).

MoneyVai Hack: Think of profits like Diwali bonuses—spend them wisely, don’t splurge blindly.

Step 9 – Stay Updated

Regularly follow these for policy shifts and market movements:

- RBI & SEBI official updates

- Moneycontrol, LawfulLegal.in

- Official exchanges’ announcements

Avoid influencers who claim guaranteed “10x returns.” That’s as reliable as a Bollywood villain’s redemption arc.

Step 10 – Treat Crypto Like Learning to Ride a Bike

- Start slow, stay consistent, avoid speeding.

- Don’t expect to master it in a month.

- Accept that crashes happen, but long-term patience pays off.

MoneyVai Says: Crypto isn’t about “moonshots” in days — it’s about learning the game over years.

11.Conclusion: The MoneyVai Way Forward

At the end of the day, crypto is not a magic lamp that will make you an overnight crorepati, nor is it the villain that drains your bank balance. It’s simply one of many tools in the big financial planning toolkit. The real hero? Discipline, patience, and smart allocation.

Think of your money like a thali. Rice (FDs, savings), sabzi (mutual funds, stocks), papad (insurance), aur thoda sa achaar (crypto). Achaar adds zing but khali achaar pe pet bharoge toh acidity pakka! The same with investments—crypto can spice things up, but only when balanced with solid, safe options.

MoneyVai’s approach is simple: plan first, invest second, dream big always. Don’t just chase FOMO—chase freedom. Because wealth isn’t about getting lucky; it’s about building a life where paisa works for you, not the other way round.

So stay curious, stay disciplined, and remember—Vai Hai Saath , Chhodo Tension ki Baat

Disclaimer :

MoneyVai shares knowledge, not instructions. The content on this blog is for learning and awareness only — it is not financial, legal, or investment advice. We create contents for Educational purposes only.Markets move, risks exist, and your money deserves decisions made with care. Always do your own research or consult a licensed advisor before acting.

MoneyVai empowers readers with reliable, fact-based financial knowledge that’s simple, clear, and never complicated like others. It brings India’s best finance, business, and tech articles—helping you grow wealth, save smartly, and stay ahead with ease.

For more in-depth, well-researched insights, explore MoneyVai Exclusive

FAQs

Is crypto legal in India in 2025?

Yes, crypto trading is legal, but regulated under taxation rules. RBI & SEBI keep a close watch. Treat it as an asset, not a currency.

Can I hold crypto for retirement planning?

Crypto should never be your main retirement fund. Use it as a small % (5–7%) of your diversified portfolio.

Do Indian banks allow buying crypto?

Yes, via UPI and bank transfers on SEBI-compliant exchanges, though with strict KYC norms.

What’s the biggest risk of holding crypto long-term?

High volatility and regulatory uncertainty. Your ₹1 lakh may become ₹5 lakh—or ₹20,000. Risk management is key.

Is crypto better than stocks or mutual funds?

Not really. Stocks/mutual funds offer stability + compounding. Crypto can be a high-risk “booster shot,” not the main meal.

Citation

Government Source Links for Crypto-related Data (2025)

- Reserve Bank of India (RBI) – Digital Rupee (e₹) Pilot

Explains the launch and usage of India’s Central Bank Digital Currency (CBDC) — the Digital Rupee.

Reserve Bank of India - RBI Press Release (2013/2016)

Clear caution issued by RBI: no authorization for dealing with cryptocurrencies.

Reserve Bank of India - AZB & Partners Review of RBI Directive (2018 ban + Supreme Court reversal)

Covers how RBI banned banks from crypto dealings in 2018, and how this was overturned by the Supreme Court.

azb - Global Legal Insights – India (2025)

Confirms that cryptos are not legal tender, only the CBDC (Digital Rupee) is.

Global Practice Guides - Finlaw Consultancy (2025 Regulatory Status Summary)

Provides concise updates: cryptos legal to trade/hold, taxable, but not recognized as currency.

finlaw.in - CAalley News (Aug 2025)

Reports CBDT seeking input on regulator rules, TDS rates, and loss-offsetting for crypto.

CAalley - SEBI Circulars Page (2025)

Although not crypto-specific, shows the regulatory structure SEBI follows—useful context for digital assets.

Securities and Exchange Board of India - IJFMR Research Paper (2025)

Academic insight into idea of a Digital Asset Regulatory Authority and legal complexities.

IJFMR