Health Insurance in India: How Much Cover Does a Middle Class Family Really Need

Table of Contents

Introduction

Do you remember hearing this phrase in a chai shop? “Bhai, mujhe toh kuch nahi hoga.” Surprisingly, according to RBI data, medical inflation in 2025 India is increasing at a rate of about 12% per year. An operation that costs ₹3 lakh now could reach ₹6 lakh in as little as six years. Imagine for a second a scenario where a single medical cost and inflation wipe out ten years of diligent SIP payments at a rate quicker than your monthly paycheck.

This is where the MoneyVai approach comes in — Consider having a street-smart dost lecture finance over momos, rather than a dull professor with PowerPoint slides. Health insurance is more than simply a policy; it serves as a financial safety net for your family. And believe me, you do not want to drive without one. Unlike random WhatsApp forward, this guide is powered by official and trusted sources.

1. The Dilemma of Middle-Class Families: How Much is “Enough”?

Picture this: You’re sitting at the dining table with your family. Your father asks, “Beta, tumhare office ka medical cover kitna hai?” You proudly say, “5 lakh!” He sighs, “Pehle ek bypass surgery ka kharcha dekh le, fir bolna.”

That’s the middle-class dilemma. On paper, ₹5–10 lakh feels like a lot. But in reality, one serious hospitalization in 2025 can wipe out not only your savings but also your sense of financial security.

According to IRDAI’s 2025 health insurance report, the average cost of a single cardiac bypass surgery in a metro like Delhi has crossed ₹4.5–6 lakh. A cancer treatment plan? ₹12–18 lakh over 1–2 years. And that’s without luxury hospital rooms — just standard packages.

MoneyVai Says: Insurance is not a luxury. It’s the oxygen cylinder you don’t value until you’re gasping for breath.

2. Breaking Down the Numbers

2.1 Cost of Healthcare in 2025

- Average hospitalization expense in India (urban): ₹38,000 (up from ₹29,000 in 2021, as per RBI’s Household Survey 2025).

- Critical illness (cancer, kidney failure, heart surgeries): ₹8–20 lakh+ depending on city.

- Post-hospitalization care (medicines, diagnostics): adds 15–20% extra.

If you’re a middle-class family with ₹12–15 lakh annual income, one major illness can eat up 2–3 years of savings.

2.2 Table: How Hospital Bills Compare with Coverage

| Treatment Type | Avg. Cost (2025) | If You Have ₹5 Lakh Cover | If You Have ₹20 Lakh Cover |

|---|---|---|---|

| Cardiac Bypass Surgery | ₹5.5 lakh | Shortfall ₹50,000+ | Fully covered |

| Cancer (1st year) | ₹12 lakh | Shortfall ₹7 lakh | Covered |

| Kidney Transplant | ₹18 lakh | Shortfall ₹13 lakh | Covered |

| Accident ICU (15 days) | ₹7 lakh | Shortfall ₹2 lakh | Covered |

MoneyVai Hack: If you can’t afford a ₹20 lakh base policy, combine a ₹5 lakh base with a ₹15 lakh super top-up. You’ll get the same protection at half the premium.

3. Voices from Quora, Reddit & LinkedIn

When I researched real people’s struggles, I found echoes of the same story:

- Quora user (Mumbai): “My father’s liver transplant cost ₹22 lakh. Our 10 lakh policy was useless. I had to break my fixed deposit meant for my sister’s wedding.”

- Reddit (r/IndiaFinance): “Don’t think 5 lakh is enough. One accident in Bangalore left me with ₹6.8 lakh bill. Thankfully, I had a top-up that saved me.”

- LinkedIn post (Senior Manager, IT Sector): “Our HR kept saying ‘we provide health cover.’ But when my child needed NICU, the corporate cover’s room rent capping ruined us. Now I pay extra for my own family floater.”

MoneyVai Says: Never depend only on company insurance. Jobs change, policies change, but diseases don’t wait.

4. So, How Much Cover Do You Really Need?

4.1 The Thumb Rule (2025 Edition)

- Minimum cover = 50% of your annual income OR

- Minimum cover = ₹10 lakh for metros, ₹7 lakh for non-metros

- Ideal cover = ₹20–25 lakh floater for family of 4

4.2 Table: Family Size vs Recommended Cover

| Family Type | Recommended Cover (2025) |

|---|---|

| Single individual (25–30 yrs) | ₹10–15 lakh |

| Couple (30–40 yrs) | ₹15–20 lakh |

| Family of 4 (metro) | ₹20–25 lakh |

| Family of 4 (non-metro) | ₹15–20 lakh |

| Parents above 60 (each) | ₹20 lakh+ |

MoneyVai Hack: If budget is tight, insure parents separately. Mixing them in your family floater shoots up premiums like crazy.

5. The Investment Trade-Off: Insurance vs SIP

Many friends ask me, “Yaar, premium dene ke bajaye SIP karun toh?”

Here’s the reality:

5.1 Table: SIP vs Insurance Payoff

| Scenario | ₹5,000 SIP for 10 years | ₹20 lakh Health Cover |

|---|---|---|

| Normal 10 years, no illness | ₹12 lakh corpus | Premiums “lost” |

| 1 major illness (year 4) | SIP = ₹2.4 lakh only | ₹20 lakh coverage available |

| Verdict | Great for wealth building | Critical for protection |

MoneyVai Says: SIP builds wealth, insurance saves wealth. You need both. Don’t confuse the goalkeeper with the striker.

6. Case Studies: From Real Lives & My Own

6.1 LinkedIn Case

A Bangalore IT professional shared how his newborn’s premature delivery cost ₹8.2 lakh. His ₹5 lakh corporate cover + ₹5 lakh top-up saved him. His post went viral with thousands commenting: “I increased my own cover after reading this.”

6.2 Reddit Case

A Pune family wrote about how cancer wiped out ₹17 lakh in 2 years. They had only ₹10 lakh policy. Result? Loans, selling jewelry. The father wrote, “Insurance shortfall feels worse than disease.”

6.3 My Own Story

When my cousin’s father had a cardiac emergency in Kolkata, the hospital demanded a ₹3 lakh deposit upfront. Their insurance TPA took 36 hours for approval. Luckily, my cousin had an emergency fund to pay instantly. Otherwise, the treatment would have been delayed. That day I realized — health cover isn’t enough, you need liquid cash too.

MoneyVai Hack: Always keep an emergency fund equal to at least 2 insurance premiums + ₹1 lakh buffer for delays.

7. Financial Planning with Health Insurance

7.1 Layering Your Protection

- Base Policy: ₹5–10 lakh

- Super Top-up: ₹15–20 lakh

- Critical Illness Rider: ₹10–20 lakh lump sum

- Emergency Fund: 3–6 months’ expenses

7.2 Why Govt Data Matters

According to SEBI’s 2025 Investor Report, only 3.4% Indians have adequate health insurance cover (above ₹10 lakh). Compare that with rising medical inflation of 9–12% annually (SBI Research 2025).

Translation? Health costs are doubling every 7 years. Your ₹10 lakh cover today is just ₹5 lakh in value by 2032.

MoneyVai Says: Think 2030 rupees, not today’s rupees, when buying cover.

8. Pros & Cons of Higher Insurance Cover

| Pros | Cons |

|---|---|

| Peace of mind | Higher annual premium |

| No shortfall in treatment | Complex paperwork if multiple add-ons |

| Covers critical illnesses | Temptation to over-insure beyond affordability |

| Tax benefit under 80D | Premium rises steeply after 50 |

MoneyVai Hack: Start early. A ₹20 lakh floater bought at 28 costs less than half of what it will at 38.

9. 3 MoneyVai Insights & Myth-Busters

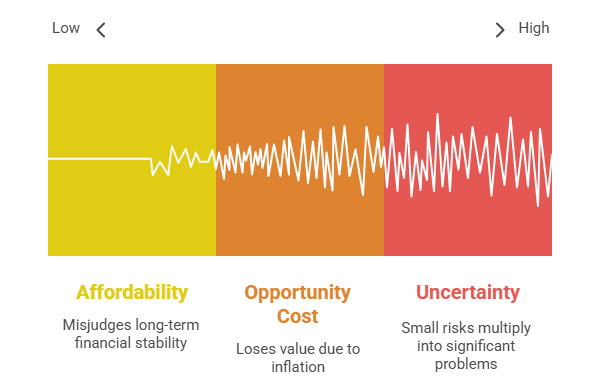

- The Compounding of Uncertainty

We always talk about compounding of money, but here’s a twist—uncertainty also compounds. Imagine you’re late to office. You miss the bus → you book an auto → traffic jam → boss gets angry. Small risks add up. In finance, a 1% health cost risk + 2% job loss risk + 3% inflation mismatch doesn’t add up to 6%. It multiplies into a life mess if you don’t plan buffers. MoneyVai Says: Treat uncertainty like EMI—if you don’t prepay, it keeps growing.

- Illusion of Affordability

A middle-class family thinks “If I can pay the EMI, I can afford it.” Wrong. EMI affordability ≠ true affordability. Real affordability is: Can you continue paying if your salary stops for 6 months? If not, you’re borrowing peace from future stress.

- Silent Opportunity Cost

Every rupee in savings account looks safe, but it’s secretly bleeding value. If inflation is 6% and your FD is 5.5%, you’re actually losing 0.5% every year. That’s like filling a leaking bucket—water looks stable till you realize it’s dripping away.

Myth vs Reality

- Myth: Insurance is just a backup plan.

- Reality: It’s actually your family’s first line of defense. Like a helmet—you don’t buy it after an accident.

- Myth: If you’re earning well, risk is less.

- Reality: Higher earners bleed more when unplanned shocks hit. A ₹10 lakh surgery wipes out more than 3 years of SIPs.

- Myth: Small savings are “safe enough.”

- Reality: Inflation is like termites—you don’t see it daily, but one day the whole cupboard (your savings) collapses.

Real-life Example:

A Reddit user earning ₹1.2 lakh/month proudly posted his “no-insurance, high-FD strategy.” Six months later, a sudden heart condition drained ₹8 lakh, wiping out 6 years of FD growth. Safety was just an illusion.

9. Straight from the SARKAR

1. Debasish Panda, Chairman of the Insurance Regulatory and Development Authority of India (IRDAI), highlighting the need for accessible, affordable insurance and infrastructure:

“Awareness, affordability, and accessibility—ye teen A’s—are key to unlocking health insurance growth of 30–35% per annum. We must expand beyond just claiming penetration numbers.”

— Mr. Panda emphasized that merely improving statistics isn’t enough; reaching every corner of India must be the priority.

( source : https://timesofindia.indiatimes.com/business/india-business/health-insurance-require-parallel-investments-irdai/articleshow/93891754.cms )

2. Deepak Sood, IRDAI Member, stressing the evolving nature of risk and importance of affordability:

“The face of risk is changing every day—today it sits right in our pockets, in our mobile phones. Pricing shouldn’t be a barrier; if premiums are low and affordable, penetration follows.”

— Mr. Sood underscored the urgent need to make insurance reachable for all Indians.

10. Call to Action (Before It’s Too Late)

If you’re reading this, don’t wait for a medical scare. Spend one weekend:

- Check your employer cover.

- Buy a base + top-up that fits.

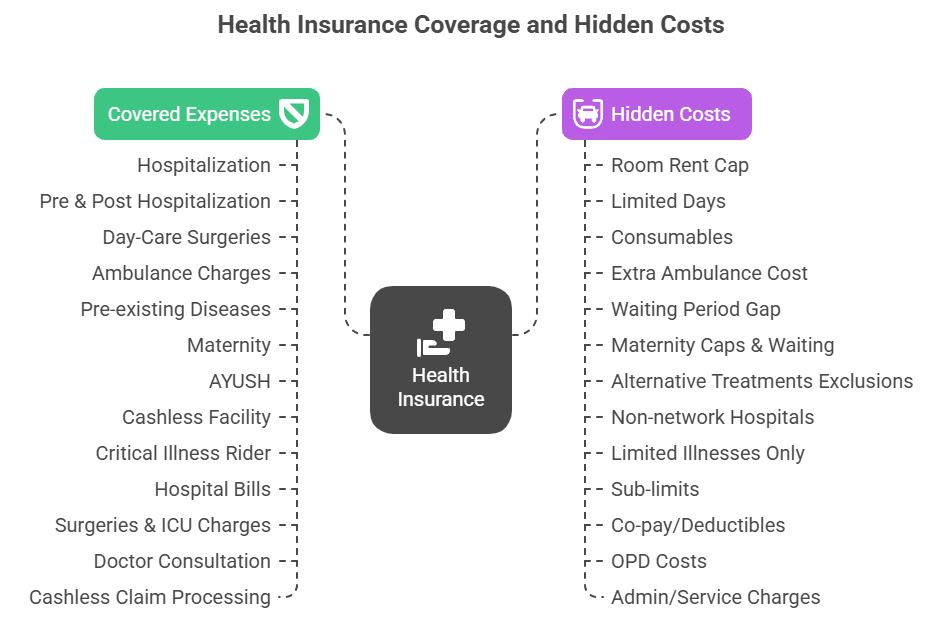

- Review riders (critical illness, room rent waiver).

- Keep receipts in a digital folder.

- Build a ₹1–2 lakh liquid emergency fund.

Because, my friend, insurance bought in panic is always expensive.

11. Conclusion

At the end of the day, health insurance isn’t just a premium you pay — it’s the peace of mind you buy for your family. Ek baar socho, life ki unpredictability ko hum control nahi kar sakte, but apni financial planning ko zaroor control kar sakte hain. The MoneyVai approach is all about keeping things simple, smart, and sustainable — kyunki paisa bachana hi nahi, usse sahi jagah protect karna bhi equally important hai.

Remember, it’s not about buying the “biggest” policy, it’s about buying the right one, at the right stage, with the right cover. Chhoti si clarity, thodi si discipline, aur ek solid plan — bas itna hi kaafi hai to make sure ek hospital bill never derails your dreams.

So next time someone asks, “Kitna health insurance enough hai?” just smile and say — Mere paas MoneyVai ka formula hai.

Vai Hai Saath , Chhodo Tension ki Baat

MoneyVai empowers readers with reliable, fact-based financial knowledge that’s simple, clear, and never complicated like others. It brings India’s best finance, business, and tech articles—helping you grow wealth, save smartly, and stay ahead with ease.

For more in-depth, well-researched insights, explore MoneyVai Exclusive

FAQs

What’s the “minimum” health insurance cover a middle-class family should consider in 2025?

At least ₹10–15 lakh as per current SBI and IRDAI recommendations, because medical inflation is rising at 12–14% annually.

Is ₹5 lakh cover (like standard govt. schemes) enough today?

Honestly, NO. One serious hospitalization in a metro can wipe it out in 4–5 days. Treat ₹5 lakh as a starter, not a safety net.

Should I buy one big family floater or separate individual covers?

For cost-effectiveness, go with a family floater (₹15–20 lakh), but ensure parents get a separate policy, since their claims can drain the cover.

How do I know if my cover is future-proof?

Simple test: Will it handle a single ₹10–12 lakh surgery bill without emptying your savings? If yes → future-proof. If no → upgrade.

Can top-up plans actually save money?

Bilkul! A ₹5 lakh base + ₹20 lakh top-up is often 30–40% cheaper than a direct ₹25 lakh cover — smart hack for middle-class families.

CITATION

Government / Institutional Data Links

- RBI’s Inflation Expectations Survey (Sept 2025 round)

- Average out-of-pocket hospitalisation spend (Govt survey)

- Group health insurance cost per employee (2025 data)

- Household per capita consumption expenditure (2023–24, MPCE)

- National Health Claims Exchange oversight & projected healthcare cost rise

- RBI average urban hospitalization expense (RBI Household Survey 2025)

Social Pages

https://www.reddit.com/r/IndiaInvestments/comments/r2fmwd/comparing_health_insurance_super_topup_plans/

https://www.reddit.com/r/personalfinanceindia/comments/1ldl8c5/why_nehas_285l_claim_was_slashed_to_half/

https://www.reddit.com/r/IndiaInvestments/comments/mig8dp/how_exactly_does_health_insurance_super_top_up/

https://www.reddit.com/r/personalfinanceindia/comments/1l4hu1x/ever_wondered_if_health_insurance_premiums_are/

https://www.reddit.com/r/IndiaInvestments/comments/1fubf5t/is_the_advice_to_buy_a_base_health_insurance/

https://www.reddit.com/r/IndiaInvestments/comments/116cc4q/health_insurance_for_senior_parents_55mother_and/

https://www.reddit.com/r/IndiaInvestments/comments/mf02s1/my_research_on_super_top_up_health_insurance_and/

https://www.reddit.com/r/personalfinanceindia/comments/1jlxmah/factors_to_consider_when_choosing_health/

https://www.reddit.com/r/IndiaInvestments/comments/mxekfy/my_thorough_research_on_base_cover_super_topup/

https://www.reddit.com/r/personalfinanceindia/comments/1m08xko/need_help_with_deciding_on_parents_health/

https://www.reddit.com/r/personalfinanceindia/comments/1lsq5xn/urgent_help_star_health_insurance_preapproved/

https://www.reddit.com/r/IndiaInvestments/comments/17yvz3a/sudden_rise_in_my_health_insurance_premium_should/

https://www.reddit.com/r/IndiaInvestments/comments/12gn5d8/how_much_health_insurance_is_enough_for_parents/

https://www.reddit.com/r/IndiaInvestments/comments/1ignpyz/health_insurance_for_seniors_65_any_good/

https://www.reddit.com/r/personalfinanceindia/comments/1lbpmvz/is_it_safe_to_port_insurance_policy_at_the_age_of/

https://www.reddit.com/r/IndiaInvestments/comments/10rkyt8/query_significant_increase_in_my_icici_lombard/

https://www.reddit.com/r/IndiaInvestments/comments/zx85yj/does_new_india_assurances_topup_policy_function/

weed for sleep gummies natural relief