Are Liquid Funds Safer Than Fixed Deposits in India?

Table of Contents

INTRODUCTION

At a wedding, you may find yourself juggling plates of biryani and gulab jamun, wondering “How do I keep all this under control?” That, my friend, is how your money feels if it is not properly parked. To be honest, we all want our money to be like that Bollywood hero: always ready to save the day without breaking a sweat. Choosing between Fixed Deposits (FDs) and Liquid Funds will significantly impact your money’s superhero cape.

The MoneyVai approach equips your funds with GPS, safety features, and turbo boost. Our approach is straightforward and actionable, including data from the RBI, SEBI, and SBI until 2025 to support informed decisions. You’ll learn where to park for safety, where to keep it nimble, and how to make every rupee work as a faithful companion.

Unlike random WhatsApp forward, this guide is powered by official and trusted sources.

1. What Exactly Are Fixed Deposits (FDs) & Liquid Funds?

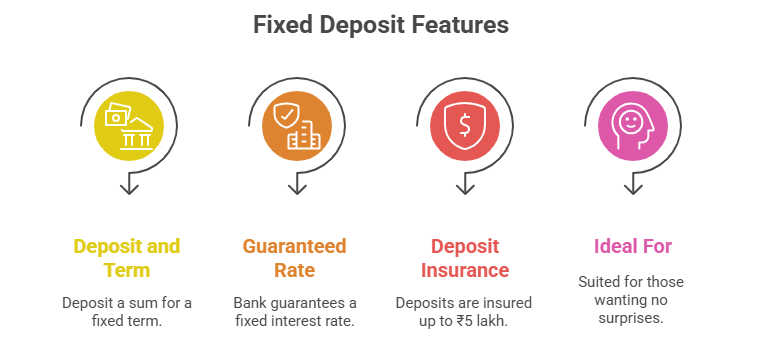

1.1 Fixed Deposits (FDs): The Granddad of Safe Investments

- You deposit a lump sum in a bank (e.g., SBI, HDFC, ICICI) for a fixed time (7 days to 10 years).

- Bank promises a guaranteed interest rate (e.g., SBI offers up to 6.60% for 2-3 years in 2025).

- Backed by Deposit Insurance and Credit Guarantee Corporation (DICGC) up to ₹5 lakh per depositor per bank (DICGC March 2025 Data).

- Ideal for people wanting zero surprises.

Real-life Example:

Rajesh (45-year-old software engineer in Mumbai) parked ₹5 lakh in an SBI FD at 6.60% in early 2025. After two years, without any market ups and downs, he earned ₹34,800 in fixed interest, covering inflation (July 2025 inflation at 1.55%, MoSPI data) and growing his nest egg safely.

MoneyVai Hack:

Always ladder your FDs, dividing them into 3, 6, and 12-month terms. This allows you to access cash on a regular basis without sacrificing returns or incurring early withdrawal penalties.

1.2 Liquid Funds: The Speedster for Idle Money

- Mutual funds investing in ultra-short-term instruments (Treasury Bills, Commercial Papers, Certificates of Deposit) maturing ≤91 days.

- Governed by SEBI’s 2025 regulations: At least 20% in government securities, low exposure to individual issuers.

- Ideal for parking idle cash like bonuses or emergency funds.

Real-life Example:

In August 2025, Priya, a freelance graphic designer in Bangalore, got paid late by a customer. She took out ₹2 lakh from the Aditya Birla Sun Life Liquid Fund, which gave her cash the next day and an annualized yield of 7.15%. There was no exit load beyond day 7.

MoneyVai Hack:

Set up auto-sweep into liquid funds from salary accounts using apps like Groww to earn 7%+ while keeping cash accessible.

2. Safety Demystified: What Does Science Say?

2.1 Credit Safety – Where FDs Lead

- DICGC covers up to ₹5 lakh per depositor per bank (principal + interest) (RBI March 2025).

- Zero volatility (Beta = 0).

- Example: Lakshmi, a Chennai retiree, relies solely on FDs for predictable monthly income without worrying about market swings.

Pro Tip:

Split your corpus across multiple banks to maximize ₹5 lakh insurance coverage.

2.2 Market Safety – Liquid Funds’ Low-Risk Edge

- Invest in AAA-rated papers, with issuer concentration capped at 10% (SEBI 2025 norms).

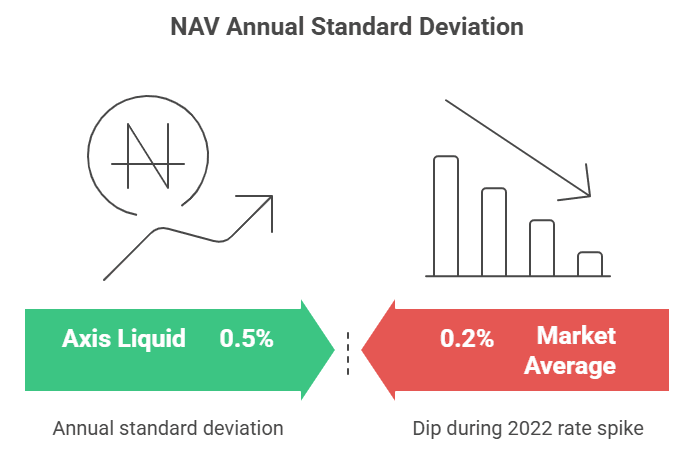

- NAV fluctuations minimal: ~0.5% annual std deviation (Source: AMFI July 2025).

- Example: Axis Liquid dipped 0.2% during the 2022 rate spike, but recovered fast.

MoneyVai Hack:

Stick to large AUM (>₹50,000 crore) funds like SBI Liquid (₹62,000 crore AUM) to lower risk.

2.3 Liquidity Safety – T+1 Redemption Wins

- Liquid Funds: Typically T+1 redemption; 99% processed without any gates (AMFI, 2025).

- FDs: Early withdrawals allowed but with a 0.5-1% penalty (e.g., Raj broke his FD in Delhi, paying ₹750 on ₹1 lakh).

Comparison Table: Liquidity in 2025

| Feature | Fixed Deposit (FD) | Liquid Fund |

|---|---|---|

| Redemption Speed | Same-day (7-45 day FDs) or T+1 for sweep FDs | T+1 (generally) |

| Pre-closure Penalty | 0.5%–1% rate cut | Graded exit load (Day 1–7) |

| Insurance | Up to ₹5 lakh per bank (DICGC) | None |

| Best for | Fixed-term goals | Emergency fund, short-term parking |

3. Case Studies Straight From the Trenches

Insta-Redemption’s Hidden Cap: The Wake-Up Call

- Imagine Sameer, a young IT professional in Bangalore, facing a medical emergency on a lazy Sunday evening. Desperate, he triggered an “instant redemption” from his liquid fund, thinking the cash would appear in his account right away.

- Reality check: Only ₹50,000 or 90% of units are allowed per day as per scheme rules. The remaining amount? Processed like regular T+1 redemption, arriving Monday morning.

That moment of helplessness taught him the hard way: “Instant” isn’t always instant. - MoneyVai Hack: Treat instant redemption as a convenience, not a replacement for your real cash buffer. Keep ₹1–2 lakh in a regular savings account for absolute “money-now” needs, and the rest in liquid funds for “money-tomorrow” moves.

FD Breakage: The Invisible Penalty Monster

Ramesh was that careful investor who thought breaking a Fixed Deposit early would simply cost a flat 1% penalty on interest. But in April 2025, when he needed ₹1 lakh unexpectedly, he broke a one-year FD booked at 6.5%.

Surprise: The bank recalculated the rate for the actual holding period (say 4 months) and then subtracted 0.5–1% penalty from that lower rate. His returns plummeted far below expectation.

The shock of seeing much lower money than planned hit him hard.

MoneyVai Hack: Ladder smaller FDs with clear maturity dates for known goals. Keep uncertain timing needs parked in liquid funds to avoid this nasty surprise.

Friday Night Redemption, Monday Morning Reality

- The Sharma family had parked their entire emergency fund in a liquid scheme. One Friday evening, in a panic, they hit “redeem”—expecting money the next morning for urgent use.

- But thanks to cutoffs and weekend banking closures, their funds only arrived Monday.

That “weekend tax” of time delayed their relief. - MoneyVai Hack: Always hold a small buffer in savings accounts for true emergencies. Use liquid funds for regular next-day expenses, not critical “right-now” cash needs.

Belt & ABS Strategy: The Twin Shield

- Meera, a risk-conscious investor, faced a tough choice—where to park ₹20 lakh safely without compromising liquidity?

Her genius solution: - Split the amount into multiple FDs, each within ₹5 lakh DICGC-insured limit per bank, guaranteeing principal safety.

- Allocate a portion in a liquid fund for seamless T+1 withdrawals.

This barbell strategy didn’t chase marginal extra yield but ensured that “bad days” never became disasters. - MoneyVai Hack: Engineer your “worst-case safe” with legal insurance limits and predictable process timelines—because peace of mind is priceless.

3.1 My Story

It was April 2025. I had just received my annual bonus—₹3 lakh. Excited, I called my friend Hogla for advice. “Put it in FDs, no drama,” he said. But I hesitated. My mind raced—what if an emergency popped up?

I split the money: ₹2 lakh into SBI FDs, insured and steady, like a warm blanket on a rainy night. ₹1 lakh went into a liquid fund. The next month, my laptop crashed mid-project. Panic? Nah. I redeemed ₹50,000 from the liquid fund T+1—money in my account the next day.

The FDs quietly continued to grow, untouchable and predictable. The liquid fund danced with small NAV ripples, but delivered operational speed when life demanded it.

MoneyVai Says: “Safety isn’t just about guarantees—it’s about freedom to act without fear.” That month, I slept better knowing both anchors were in place.

4. Returns vs. Risks – 2025 Data Speaks

4.1 Fixed Deposit Yields

- SBI FD Rates (2025):

• 1 year: 6.25%

• 2–3 years: 6.60%

• Senior Citizens Bonus: +0.50% (i.e., up to 7.10%).

Post-tax returns (30% bracket): ~4.5%-5% per annum.

4.2 Liquid Fund Returns

- Average 3-year annualized return: 7.02% (ET Money, 2025).

- Risk: NAV fluctuation ~0.2%-0.5% daily (historical low volatility).

Returns vs. Risks Snapshot

| Investment Type | Average Return (2025) | Taxation | Risk Profile | Liquidity |

|---|---|---|---|---|

| Fixed Deposit (FD) | 6.5%–7.1% | Slab | Very Low | Premature penalty |

| Liquid Funds | 6.9%–7.5% | Slab | Low-Medium | T+1 Redemption |

NOTE : FD rates vary bank to bank.

MoneyVai Hack:

If holding liquid funds >2 years, benefit from 12.5% LTCG without indexation; otherwise, slab-taxed.

5. Taxation – 2025 Fine Print You Must Know

- FD Interest:

Taxed as per your income slab (TDS kicks in if interest > ₹40k annually). - Liquid Funds:

Post-Apr 1, 2023 purchases are slab-taxed, no indexation.

Example:

Shymal earned ₹10k from FD interest → ₹3k tax (30%).

Nitika held liquid funds >2 years → ₹7k profit taxed at 12.5% → ₹875 tax.

MoneyVai Hack:

Use Form 15G to skip TDS if total income is under taxable limit.

6. The Science Behind “Low Risk” in Liquid Funds

- Maturity Cap at 91 Days keeps duration and price sensitivity minimal.

- Linked to RBI-run T-Bill auctions → yields reflect short-term market rates.

- SEBI mandates graded exit load for first 7 days → discourages hot-money churn.

MoneyVai Says:

“Safety isn’t a vibe—it’s clearly defined by DICGC limits, SEBI’s graded exit load, and T+1 timelines. Don’t gamble on hearsay.”

7. Pros & Cons: The Ultimate Comparison Table (2025 Data)

| Aspect | Fixed Deposit (FD) | Liquid Fund |

|---|---|---|

| Safety | DICGC ₹5 lakh insurance | No insurance, but AAA rated papers |

| Returns | Fixed 6.5%-7.1% | 6.9%-7.5%, market-linked |

| Liquidity | Pre-closure penalty (0.5%-1%) | T+1 redemption, first 7-day exit load |

| Taxation | Slab-rate tax | Slab-rate; LTCG 12.5% (if held >2 years) |

| Risk Level | Very low (0% volatility) | Low-medium (~0.5% volatility) |

| Best For | Date-certain goals, retirees | Emergency corpus, short-term needs |

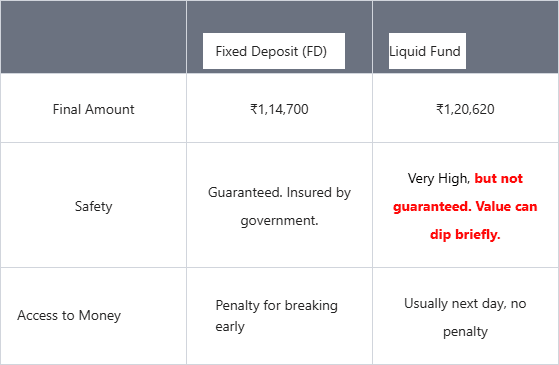

8. Fixed Deposit (FD) vs Liquid Fund : Number’s Game

The Math for ₹1,00,000 invested for 3 years

Assumptions:·

- FD Interest Rate: 7% per year·

- Liquid Fund Return: 7% per year (but not guaranteed)·

- Your Income Tax Slab: 30%·

- Inflation: 6% (for indexation)

1. Fixed Deposit (FD)·

Pre-Tax Profit: ₹1,00,000 * 7% * 3 = ₹21,000

Tax You Pay: ₹21,000 * 30% = ₹6,300

Final Money in Hand: ₹1,00,000 + (₹21,000 – ₹6,300) = ₹1,14,700

2. Liquid Fund (Held for 3+ years for tax benefit)

Pre-Tax Profit: ~₹21,000 (same as FD)

Indexation Adjustment (Inflation Magic)

Adjusted Purchase Price: ₹1,00,000 * 1.06 * 1.06 * 1.06 ≈ ₹1,19,100

Taxable Profit: ₹1,21,000 (Value) – ₹1,19,100 = ₹1,900

Tax You Pay: ₹1,900 * 20% = ₹380

Final Money in Hand: ₹1,21,000 – ₹380 = ₹1,20,620

Note : This is an educational analysis. We use data which are close to reality.

The Number Comparison

Actionable Conclusion: What Should You Do?·

Use an FD if: You cannot stomach the word “risk” at all. Your main goal is 100% capital protection for a specific, important goal. You are a senior citizen needing fixed, predictable income.·

Use a Liquid Fund if: You are keeping an emergency fund or parking money for short-term goals (even a few months). You want higher post-tax returns and can accept a microscopic risk that your value might drop by a few rupees for a day or two.

Simple Rule: For money you might need to access quickly (your emergency fund), a Liquid Fund is often the smarter choice because of better returns and easy access. For money you are sure you won’t touch for the full FD term, an FD is simpler and guaranteed.

Disclaimer : All investments carry risk. Liquid funds are not insured and are subject to market risks. While they are considered low-risk, their value can fluctuate, and there is no guarantee of returns. Please read all scheme-related documents carefully before investing.

9. MoneyVai Special Insights & Myth-Busters

- The Liquidity Premium Paradox

Most people think liquid funds are “just slightly better than a savings account.” Truth bomb: That extra 1–2% yield isn’t random—it’s the liquidity premium.- Why? Because when you park money in a liquid fund, you accept a small chance of tiny delays or exit loads in exchange for a higher return.

- Real Story: Shreya parked ₹5 lakh in a savings account and earned a meh 3.5% annually. Then she switched to a Liquid Fund and now earns 7%—all because she was okay giving up absolute instant access sometimes.

Think of it like paying ₹50 extra for express delivery rather than waiting a week.

- Regulatory Arbitrage: The Invisible Market Rulebook

- SEBI’s rule to invest only in AAA-rated papers isn’t just “safer”—it’s a deliberate game design.

- This rule keeps default risk low but trims yields compared to riskier debt.

- Example: Arun shifted from a corporate bond fund to a liquid fund. His returns dropped by just 0.15%, but the peace of mind skyrocketed.

It’s like preferring a certified electrician over the random guy—you pay a little more but sleep well.

- SEBI’s rule to invest only in AAA-rated papers isn’t just “safer”—it’s a deliberate game design.

- Interest Rate Sensitivity: The Silent NAV Wiggle

- Small RBI rate hikes still jiggle your liquid fund NAV.

- June 2025’s repo rate hike of 0.25% caused a 0.3% NAV dip for Vikram overnight.

It’s like a pothole on your daily route—annoying, but nothing a savvy driver worries about.

- Small RBI rate hikes still jiggle your liquid fund NAV.

MoneyVai Says: “Smart investors don’t fear small dips—they understand why they happen.”

9.1 Myth vs Reality

- Myth: Liquid Funds are absolutely risk-free, just like Fixed Deposits.

Reality: Liquid Funds are low-risk but not no-risk. Even top AAA-rated securities can face temporary NAV fluctuations during policy changes or market shocks.

Example: In July 2025, when the RBI unexpectedly hiked repo rate, Gunjan’s liquid fund NAV briefly dipped by 0.2%. She panicked initially but understood later it was just a transient effect. - Myth: You can withdraw your liquid fund instantly, anytime, without any cost.

Reality: First 7 days carry a graded exit load (0.1%-0.3%), designed to prevent hot-money churn.

Example: Prakash withdrew ₹1 lakh from his liquid fund in just 3 days of investing. His exit load was ₹300—he later realized waiting for Day 8 would have saved him that. - Myth: Liquid Funds don’t require active monitoring.

Reality: You must track fund AUM and portfolio quality, especially after rate changes or large redemptions.

Example: Lakshmi blindly parked ₹10 lakh in a small liquid fund. Post a corporate default in August 2025, its NAV cratered by 0.5%. Luckily, she noticed early and shifted to a top-AUM fund.

MoneyVai Says: “Don’t just believe what you hear. Know the science behind safety, liquidity, and yields.”

10. Call to Action

- Step 1: Pause & Visualize

• Close your eyes and imagine your money like water in a river—some you want to store in a dam (FD), some you want flowing fast to meet urgent needs (Liquid Fund).

• Emotional trigger: Security vs. Freedom. Recognize which feeling dominates today. - Step 2: Quantify Your Needs

• List short-term cash requirements (emergencies, bills, bonuses).

• List long-term goals (retirement, kid’s tuition, travel).

• Emotional trigger: Clarity over anxiety. Seeing numbers reduces fear. - Step 3: Split Your Corpus

• Decide the ratio: e.g., 60% FD for safety, 40% Liquid Fund for instant access.

• Emotional trigger: Control—your money is working, not sleeping idle. - Step 4: Choose the Right Banks & Funds

• For FDs: Ensure each deposit ≤ ₹5 lakh to maximize DICGC insurance.

• For Liquid Funds: Pick top AUM funds (>₹50k crore) with ≥20% govt securities, liquid assets (SEBI 2025 data).

• Emotional trigger: Confidence—trust backed by government & data. - Step 5: Ladder & Time Your Investments

• FDs: Split into 3, 6, 12-month tenures.

• Liquid Funds: Set auto-sweep monthly for idle cash above 1 month.

• Emotional trigger: Peace of mind—liquidity and growth in sync. - Step 6: Track & Adjust Quarterly

• Monitor returns, inflation, repo rate changes (RBI July 2025 data).

• Adjust FD ladder or liquid fund exposure if yield gap >1%.

• Emotional trigger: Mastery—you’re steering your financial ship, not drifting. - Step 7: Mind the Tax Edge

• FD interest: Check slab & Form 15G for TDS under ₹40k.

• Liquid Funds: Hold >2 years for LTCG 12.5%, else slab-taxed.

• Emotional trigger: Satisfaction—keeping more of your hard-earned money. - Step 8: Emergency Drill

• Keep “Day 0–7 expenses” in savings or FD sweep.

• Rest in high-quality liquid fund.

• Emotional trigger: Calm—you’re ready for the unexpected. - Step 9: Reassess Goals Annually

• Life changes? Increase/decrease liquidity ratio.

• Emotional trigger: Growth—your plan evolves as you evolve. - Step 10: Celebrate Micro Wins

• Every quarter, note interest earned or smooth T+1 redemptions.

• Emotional trigger: Joy—money working while you live your life.

MoneyVai Says:

“Control, safety, and speed—this trifecta turns financial fear into financial freedom. Start small, act today, and feel your money breathe for you.”

11. CONCLUSION

At the end of the day, whether you lean towards Fixed Deposits for rock-solid safety or Liquid Funds for quick-access agility, it’s all about taking charge of your money with confidence. FDs give you that steady, predictable growth—jaise ek loyal friend jo kabhi fail nahi hota. Liquid Funds let your cash dance and flow, ready to rescue emergencies or fuel spontaneous opportunities.

Financial planning isn’t rocket science—it’s about strategy, balance, and smart splits. Abhi ka waqt hai, apni savings ko ladder, sweep, aur diversify karke har situation ke liye tayyar rakhne ka. Plan your money, but also learn from others—share this article with someone who can relate, aur comment karo niche kaise aap apni money split kar rahe ho for safety and growth.

Your journey, your rules, your financial freedom—own it. Vai Hai Saath , Chhodo Tension ki Baat

Disclaimer:

MoneyVai shares knowledge, not instructions. The content on this blog is for learning and awareness only — it is not financial, legal, or investment advice. We create contents for Educational purposes only.Markets move, risks exist, and your money deserves decisions made with care. Always do your own research or consult a licensed advisor before acting.

FAQs

- Are liquid funds truly risk-free compared to FDs?

No—while liquid funds invest in short-term AAA-rated instruments, they carry minimal NAV fluctuations and no insurance, unlike FDs covered by DICGC up to ₹5 lakh. - Does pre-closure of an FD make it less safe than a liquid fund?

Safety of principal remains, but premature withdrawal reduces effective returns due to penalties, whereas liquid funds allow T+1 redemption with only minor graded exit load in the first 7 days. - How does SEBI’s 7-day graded exit load impact liquid fund safety?

It prevents “hot money” churn, slightly restricting immediate liquidity but maintaining operational stability and risk containment for investors. - Can liquid fund NAVs go negative in practice?

Yes, on rare days due to credit events or mark-to-market valuation, but duration caps ≤91 days minimize volatility compared to longer debt instruments.

- For high-value deposits (>₹5 lakh), which is safer scientifically?

FDs require diversification across multiple banks to fully utilize DICGC insurance, whereas liquid funds remain market-linked with low but non-zero risk; safety is context-dependent.

CITATION

Case Studies

GOVT PAGE

- DICGC Deposit Insurance FAQs

- SEBI Circular: Risk Management Framework for Liquid & Overnight Funds

- RBI Primer: Government Securities Market in India

- RBI Market Data: Government Securities (T‑Bills)

- PIB: Capital Gains Tax Regime (Union Budget 2024‑25)

- Income Tax: Tax on Long‑Term Capital Gains (Official Tutorial)