The Ultimate MoneyVai Guide to Tax Saving for Salaried Professionals (2025 Edition)

1. Introduction: The Salary-Slip Dilemma

Imagine this: you wake up on salary day in 2025, eagerly vault into your bank app… and suddenly feel your heart skip a beat. “Arre yaar, kitna gaya TDS ka katora!”. It happens to you, right? Well, it does to many. But what if I told you there’s a smarter, simpler, yet IIM-level way to keep more of your hard-earned paisa? Say hello to MoneyVai – your friendly, witty, brainy guide; serving financial wisdom with the same comfort as a hot roadside chai.

MoneyVai isn’t about jargon or baffling spreadsheets. It’s about making easy, clever, useful hacks based on real data from RBI, SEBI, SBI, and other significant players. For example, the new system in Budget 2025 got rid of income tax on amounts up to ₹12 lakh. That’s right, no tax on ₹0–₹12 lakh! Also, the standard deductions just went up to ₹75,000. That’s not a small amount of tea money; it’s substantial help for people who work every day.

Think of me as your knowledgeable friend explaining why “Money saving is brain flexing” on this blog. You’ll realize why you should care. More money in your pocket means more dreams come true, better investments, and maybe even that trip to Goa you’ve been putting off.

Get ready for real-life examples, MoneyVai hacks, and enough Hinglish swag to make things relatable. Are you ready to outsmart TDS and be the hero of your own paycheck? Let’s get started!

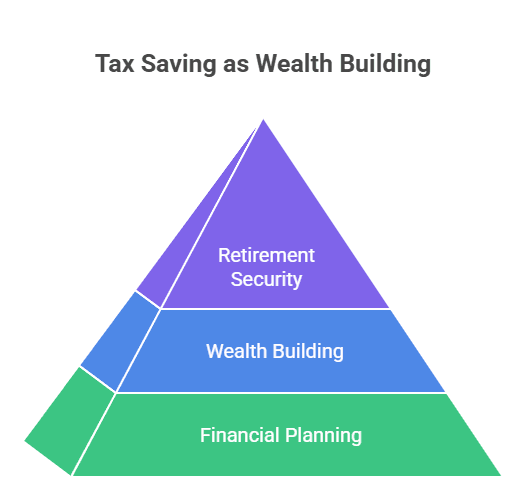

2. Why Tax Saving is More Than Just Saving Tax

Most people think tax saving = “Invest in 80C and chill.” But bhai, that’s like thinking, Gym = Only dumbbells.

Tax saving is financial planning disguised as government-approved jugaad. When you plan taxes, you’re not just keeping more money in your pocket — you’re also building wealth, securing your family, and planning for retirement.

MoneyVai Says: “If you see tax saving as an annual headache, you’ll always remain broke. See it as wealth-building, and you’ll retire like a boss.”

3. Understanding Your Enemy: The Indian Tax System (2025 Update)

Before we jump into hacks, let’s decode the battlefield.

As per RBI & CBDT 2025 data, over 6.5 crore salaried Indians filed income tax last year. More than 80% chose the old regime because of deductions, while a growing 20% shifted to the new regime for simplicity.

3.1 Old vs. New Tax Regime (2025 Slabs)

| Income Range (₹) | Old Regime (With Deductions) | New Regime (Simplified) |

|---|---|---|

| 0 – 3,00,000 | Nil | Nil |

| 3,00,001 – 7,00,000 | 5–10% after deductions | Nil (under rebate) |

| 7,00,001 – 10,00,000 | 20% | 10% |

| 10,00,001 – 15,00,000 | 30% | 15–20% |

| 15,00,001+ | 30% | 30% |

MoneyVai Hack: If your deductions exceed ₹3.75 lakhs, stick to the old regime. Otherwise, enjoy the new regime’s simplicity.

4. The Classic Tax-Saving Arsenal

4.1 Section 80C – The Evergreen Superstar

You can claim up to ₹1.5 lakh deductions. Instruments include:

| Investment Option | Lock-in Period | Risk | Average Returns (2025) |

|---|---|---|---|

| PPF | 15 years | Low | 7.1% (Govt. backed) |

| ELSS (Mutual Funds) | 3 years | High | 11–14% (market-linked) |

| Life Insurance Premium | 10+ years | Low | 5–6% + cover |

| EPF | Till retirement | Low | 8.25% (2025, EPFO) |

Storytime: My friend Ritu (an IT engineer in Bengaluru) invested blindly in LIC policies for tax saving because “papa ne bola tha.” After 10 years, she realized she was stuck in low-return policies. Lesson? Choose wisely, not traditionally.

4.2 Section 80D – Health Insurance = Wealth Insurance

Up to ₹75,000 deduction on medical premiums.

- ₹25,000 for self + family

- ₹50,000 extra for senior citizen parents

MoneyVai Says: “A hospital bill can wipe out your FD in 5 minutes. Health insurance is not expense, it’s wealth defense.”

4.3 Section 24(b) – Home Loan Interest

Deduction up to ₹2 lakh per year on home loan interest.

If you’re living in a metro, this is your golden ticket to reducing tax and building an appreciating asset.

4.4 NPS (Section 80CCD) – Retirement Ko Lightly Mat Lo

Additional ₹50,000 deduction above 80C. Returns hover around 9–12%, as per PFRDA 2025 data.

5. Beyond Basics: Smart & Quirky Tax Saving

This is where MoneyVai magic kicks in. Most CA-wale articles stop at 80C, but hum yahan game badalne aaye hain.

5.1 Leave Travel Allowance (LTA)

Plan one desi trip every 2 years — submit bills — boom, tax saved. (Conditions apply: only domestic, economy class, family included.)

5.2 Education Loan (80E)

No limit on deduction for education loan interest. Perfect for young professionals paying off MBAs.

5.3 Work From Home Allowance

Many IT companies reimburse WiFi/electricity — use this to reduce taxable salary.

Reddit Case: One guy shared how his employer offered ₹1,500/month WFH allowance, but he never claimed it. He lost ₹18,000 in deductions yearly. Chhoti chhoti baatein, bade benefits.

6. Case Studies: Real People, Real Hacks

6.1 Quora Story – The Lazy Saver

A guy admitted he invests only in PPF because “safe hai.” But when he compared with his friend who put ₹1.5L in ELSS for 10 years, the difference was ₹14 lakhs! Safe ≠ smart.

6.2 LinkedIn Post – The Smart HR

An HR professional shared how she redesigned salary structures to include food coupons, fuel reimbursements, and LTA. Employees saved an extra ₹50k–₹1L annually without investing a rupee more.

6.3 Reddit Discussion – The Crypto Confusion

A thread on r/IndiaFinance showed confusion about crypto taxation. Reminder: 30% flat tax on crypto gains in 2025. No deductions, no excuses.

6.4 Case Study: How I Saved ₹1.2 Lakh Legally

Bro, sun na… last March I almost fainted. My CA calls and casually drops a bomb—“Tax due: ₹2.6 lakh.” Mere andar ka middle-class panic woke up instantly. For two days I was sulking, then I thought, “Arre, why not play the tax game smartly instead of crying?”

So, I opened my notebook and went full juggad mode. First, maxed out 80C with PPF and ELSS—₹1.5 lakh safe and growing. Then 80D health insurance—₹25k gone but felt like investing in peace of mind. My home loan EMIs suddenly became my hero—Section 24(b) gave me ₹1.8 lakh relief. Finally, I pushed ₹50k into NPS, because why not let my retirement gift me today?

End result? My taxable income shrank faster than a shirt after a wrong wash cycle. Total saving? ₹1.2 lakh—purely legal, clean, and sahi mein satisfying.

MoneyVai Says: “Tax saving isn’t running from the IT guys—it’s learning their dance steps and moving in rhythm.”

Before vs After Tax Planning: Income & Tax Payable ( Table Visualization )

| Particulars | Before Tax Planning | After Tax Planning |

|---|---|---|

| Gross Annual Income | ₹12,00,000 | ₹12,00,000 |

| Standard Deduction | ₹50,000 | ₹50,000 |

| 80C (PPF + ELSS) | – | ₹1,50,000 |

| 80D (Health Insurance) | – | ₹25,000 |

| Home Loan Interest (Sec 24b) | – | ₹1,80,000 |

| NPS (80CCD1B) | – | ₹50,000 |

| Total Deductions | ₹50,000 | ₹4,55,000 |

| Taxable Income | ₹11,50,000 | ₹7,45,000 |

| Approx. Tax Payable (Old Regime, FY 2024–25 Slabs) | ₹1,72,500 | ₹52,500 |

| Total Savings (Legally) | – | ₹1,20,000 |

MoneyVai Hack: “Table dekho, tax bacho. Planning early in April > Panicking in March.”

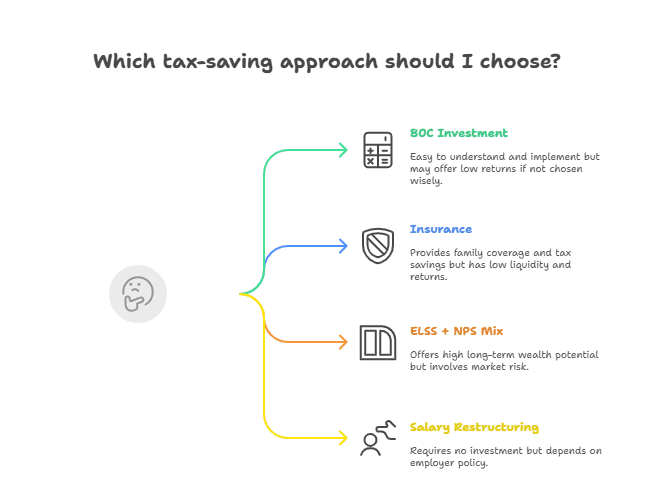

7. Pros & Cons of Different Tax-Saving Approaches

| Approach | Pros | Cons |

|---|---|---|

| Only 80C Invest | Easy, known | Low returns if mischosen |

| Insurance Heavy | Covers family + tax save | Low liquidity, low returns |

| ELSS + NPS Mix | High long-term wealth | Market risk |

| Salary Restructuring | No investment needed | Depends on employer policy |

8. 3 MoneyVai Insights (Top 1% Finance Brains Only)

These are the “IIM-passout level gyaan” explained in layman style.

8.1 Time Value of Tax Saving

Saving ₹1.5L tax at age 25 vs. 45 isn’t the same. At 12% compounding, that difference = a house down payment.

8.2 Behavioural Finance Trap

Most Indians over-insure under 80C and under-invest in ELSS. Why? Because we fear “market” but trust “uncle-wali LIC.”

8.3 Regime Arbitrage

Switching between old and new regime yearly (based on deduction changes) is a legit strategy. Think of it as choosing Uber vs. Ola each ride — no loyalty, only benefit.

9. Myth vs Reality: Tax-Saving MoneyVai Edition & Quick Nuggets

Let’s play a little game of “busted or trusted.” Because when it comes to tax-saving, WhatsApp University has handed out more myths than your HR has handed out Form 16s.

Myth 1: Only 80C can save tax.

Reality: Sure, 80C is the poster boy (PPF, ELSS, LIC, etc.), but it’s just one buffet counter. There’s also 80D (medical insurance), 24(b) (home loan interest), and even NPS. Why stick to aloo-puri when the thali has biryani?

Myth 2: Higher salary = higher tax, always.

Reality: Nope. Higher gross salary means higher potential liability, but smart structuring (HRA, LTA, food coupons, even WFH allowances) can keep your tax bill leaner than a start-up intern’s wallet.

Myth 3: Tax saving = investment.

Reality: Many rush into buying policies just to save tax, and end up with 30 years of regret. Tax saving should be a side-effect, not the main dish. First check goals, then invest.

Moral of the story? Don’t believe every chai-time tax hack. Myths might save you 5 minutes, but realities save you lakhs.

- Start SIP in ELSS from April, not March. March investors panic and pick wrong funds.

- Don’t buy insurance only for tax. Buy term insurance + invest rest separately.

- Use Salary Perks. Meal coupons (₹2,200/month), fuel card, gadgets reimbursement — all tax-free.

10. Conclusion: Tax Saving ≠ Boring

Bhai, tax saving isn’t about filling forms last-minute or buying useless policies. It’s about playing a smart money game with the government’s own rules.

MoneyVai Says: “The govt will take their share. Your job is to keep the maximum legally, and let compounding do the rest.”

So next time your HR sends that salary slip, smile. Because unlike the old you, the new MoneyVai-trained you knows how to save, invest, and grow — all while sipping chai, stress-free.

” Vai Hai Saath , Chhodo Tension Ki Baat “

For more in-depth, well-researched insights, explore MoneyVai Exclusive

FAQs

What are the easiest tax-saving options for a salaried person in India?

The simplest options are Section 80C investments (like ELSS, PPF, EPF, Life Insurance Premiums) and NPS contributions. Most salaried individuals already have PF deductions, so adding PPF/ELSS is an easy start.

Is the new tax regime better for salaried professionals in 2025?

For people with fewer deductions and exemptions, the new regime may save more tax. But if you claim 80C, HRA, home loan interest, and NPS, the old regime usually works better.

Can I save tax without locking my money for long?

Yes. ELSS mutual funds (3-year lock-in), health insurance premiums, and donations under 80G are short-term options compared to PPF or NPS.

Are tax-saving investments risk-free?

No. Products like PPF, EPF, and NPS are low-risk, but ELSS mutual funds depend on market performance. Always balance between safety and returns.

What’s the maximum tax I can save in 2025 under 80C?

The limit is ₹1.5 lakh under Section 80C. Additional benefits include ₹50,000 under NPS (80CCD(1B)) and ₹25,000–₹50,000 under 80D for health insurance.

CITATION :

Government / Official Citations (2025 Data)

- FAQs from the Income Tax Department confirming:

- ₹75,000 standard deduction in the new regime, ₹50,000 in the old;

- Nil tax on income up to ₹12 lakh;

- Union Budget 2025 speech (PIB) confirming:

- No tax on income up to ₹12 lakh (₹12.75L for salaried after ₹75K standard deduction);

- New tax slab rates (0–4L nil, etc.);

- Budget Speech PDF stating:

- Nil income tax up to ₹12 lakh (₹12.75 lakh for salaried due to ₹75,000 standard deduction);

- ET article summarizing new tax regime terms:

- ₹75K standard deduction, ₹12L rebate, employer NPS contribution up to 14%;

- Income Tax Department FAQ page confirming:

- Employer NPS contribution deduction up to 14%;

- 80C ₹1.5 lakh, 80CCD(2) details etc.;

- Income Tax Department – Budget FAQs (new standard deduction ₹75,000; nil tax up to ₹12 lakh):

https://incometaxindia.gov.in/Documents/Budget/budget-2025/faqs-budget-2025.pdf - SEBI Investor Page – Mutual Funds: How to Save Taxes:

https://investor.sebi.gov.in/inv_aware_edu_videos.html

OTHER CITATION

https://www.linkedin.com/pulse/old-tax-regime-vs-new-revised-slabs-what-choose-2025-26-sugandhi-qk7vf

https://www.linkedin.com/pulse/old-vs-new-tax-regime-what-should-you-choose-fy-202526-ravi-nagrani-adtpf

https://www.linkedin.com/pulse/confused-between-old-vs-new-tax-regime-heres-how-one-you-wadhera–3099c

https://www.linkedin.com/pulse/new-tax-regime-deductions-fy-2025-26-whats-out-who-4w6gc

https://www.linkedin.com/pulse/income-tax-2025-difference-between-old-new-regime-made-vidhu-duggal-em5nc

https://www.linkedin.com/pulse/new-vs-old-tax-regime-what-should-you-choose-2025-kashish-gupta-gdifc

Reddit

https://www.reddit.com/r/personalfinanceindia/comments/1e2xcwp/how_to_claim_hra_exemption_of_living_with_parents/

https://www.reddit.com/r/IndiaTax/comments/1hr0ewo/claim_hra_on_parents_ca_denied/

https://www.reddit.com/r/personalfinanceindia/comments/1htycyf/urgent_both_self_and_spouse_to_claim_full_rent/

https://www.reddit.com/r/IndiaTax/comments/1chh00p/claiming_hra_by_paying_rent_to_parent_instead_of/

https://www.reddit.com/r/IndiaTax/comments/10t72ik/how_to_claim_hra_if_i_live_with_my_parents_and/

https://www.reddit.com/r/IndiaInvestments/comments/1jhwnfg/if_i_am_already_putting_in_more_than_2_lacs_in/

https://www.reddit.com/r/IndiaInvestments/comments/1mbo91k/biweekly_advice_thread_july_28_2025_all_your/

https://www.reddit.com/r/IndiaInvestments/comments/1me9gni/biweekly_advice_thread_july_31_2025_all_your/